Japanese and Chinese Markets Continue Strong Growth with New Policy Initiatives

Major Asia Pacific Photovoltaic Markets to Reach 26% of Global Demand by 2015

Contributed by | SolarBuzz News

Asia Pacific photovoltaic markets are set to grow rapidly and are projected to account for approximately one-quarter of global demand by 2015, up from 11% in 2010, according to the latest Asia Pacific Major PV Markets report from Solarbuzz. The top five markets in this region—China, Japan, India, Australia, and South Korea—are projected to account for 3.3 GW of demand in 2011, with China and Japan leading the region.

Each major Asia Pacific country market is currently undergoing significant alternations to its policy structure. While China, India and Australia are building on-grid markets for the first time, Japan and South Korea face policy transitions that are re-stimulating their domestic demand over the next two years. Following the establishment of a manufacturing base that now accounts for approximately 50% of global production, China is stimulating its domestic demand through both national and provincial programs. This will cause China’s market to expand in 2011 by up to 174% over its 2010 level.

“Market growth expectations are high for the region, China and India in particular, as they each have multi-gigawatt project pipelines. However, the largest challenge facing many of these projects is the need to secure financing amidst a still evolving policy and regulatory environment,” said Craig Stevens, President of Solarbuzz. “If these policies are successful in delivering the projected growth for the Asia Pacific region, it will help offset the impact of incentive cuts across Europe.”

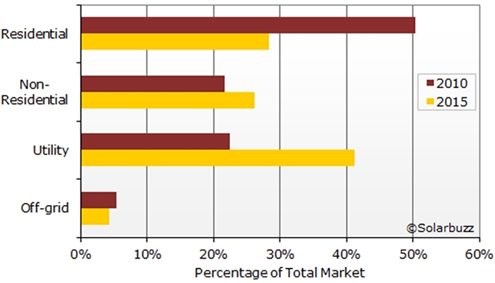

In terms of customer segments, growth will be led by utilities, forecast to become the largest customer segment as the markets move away from the current dominance of residential installations.

Figure 1. Customer Segmentation in Major Asia Pacific Markets

Source: Solarbuzz® 2011 Asia Pacific Major PV Markets report

PV Growth in Japan Stimulated by New Government Initiatives

With the implementation of a nationwide net feed-in tariff, the Japanese solar PV market is expected to install at least 1.29 GW of new PV capacity in 2011. This represents growth of approximately 35%, a sharp contrast to established European markets which are displaying low growth or even contraction during 2011. Non-residential installations, while not representing the majority of total capacity, are growing at more than twice the rate of residential system installations. Japan was the fourth largest PV market in the world in 2010, doubling for a second year in a row and installing 960 MW, thanks to re-launch of the nationwide residential incentive program and the net feed-in tariff. The Fukushima nuclear disaster has led to calls from domestic cell manufacturers to push for enhanced renewable energy policies. Meanwhile, the share of imported modules has grown more than 138% Y/Y, accounting for 13% of module shipments in Japan last year.

China PV Market Ready to Break GW Level

On-grid installations in China are projected to double in 2011 as Chinese incentive policies increase the pace of large and utility-scale PV installations. In 2010, 85% of demand in China was from projects larger than 1 MW and the latest temporary on-grid tariff announcement in Qinghai province will further boost shares of ground-mount utility projects in 2011. Programs such as the Golden Sun and Solar Rooftop programs maintain prominence going forward as developers continue to advance projects towards completion. Provincial FIT policies in Jiangsu and Shandong also made significant contributions to overall demand. With improving policy environments at both central and local government levels, as well as a near 10 GW project pipeline, the PV market in China is ready to deliver strong growth through 2015.

Strong Growth in India's On-Grid Market

The on-grid ground-mount segment is expected to lead the way in building India’s installed capacity, with installations expected to at least double in 2011. The National Solar Mission, as well as state level policies in Gujarat, Rajasthan, and Maharashtra are leading to strong growth, with these three states accounting for as much as 70% of the total Indian market in 2011. Armed with the goal of installing 22 GW of new solar capacity by 2022, the National Solar Mission has sanctioned 300 MW of on-grid PV capacity to be installed through 2011 and 2012, with an additional 300 MW to be allocated in 2H’11. Though the first round of projects has experienced setbacks due to high capital costs, low returns, and regulatory hurdles, a potential restructuring of project guidelines is likely to stimulate higher success rates of future projects. As of June 2011, the on-grid pipeline of projects targeted for completion by 2013 stood at 1.5 GW.

South Korea Moves Toward RPS

Although projected to contract in 2011 due to the phase-out of the country’s FIT program, longer-term growth potential in South Korea remains stable as new Renewable Portfolio Standards are implemented. The new RPS is expected to install 1.2 GW of new PV capacity over the next five years, although at a much slower pace than in past years. Decreased incentives under the FIT and RPS significantly slowed large ground-mount installations in 2010, paving the way for strong growth in the building-mount segments. This trend is expected to continue over the next few years, as the Korean government seeks to incentivize small and building-mount applications.

Australia PV Market Grows Despite Erratic Policy Movements

The Australian government’s latest energy policy takes the form of a carbon tax, which will transition to a cap-and-trade system in 2015. The introduction of this policy comes on the heels of several dramatic policy changes, including an increase in the rate of decline for Australia’s main PV incentive program, Solar Credits, and the implosion of several state-based feed-in tariff programs. The 431% market growth in 2010 came despite an attempt by the government to reign in demand for PV installations. The economics of PV systems have been enhanced by decreasing installed system costs, due to falling global module prices, an increasing number of accredited installers, and expectations of increasing retail electricity prices. New South Wales accounted for 44% of the national market, but now faces market disruption following cessation of the Solar Bonus Scheme in April. Fragmented and stop-start solar policies remain the largest stumbling block to long-term sustainable growth for the PV industry in Australia.

Solarbuzz Asia Pacific Major PV Markets Report Now Available

The Solarbuzz Asia Pacific Major PV Markets report provides detailed insight into the major Asia Pacific countries active in the PV market, with analysis on Japan, China, India, South Korea and Australia, including market segmentation, government policies, downstream acquisitions, project-by-project listings, investment economics, downstream market pricing and market forecasts. The report also examines data analysis and commercial insight into country specific PV market segments, making this report critical for sales and marketing decision-making for PV companies, equipment manufacturers, materials suppliers and PV systems integrators.

The 2011 Solarbuzz regional reports (European PV Markets, United States PV Market and Asia Pacific Major PV Markets) are now available—bringing clarity to this complex sales and market environment. Featuring more than 300 pages for each region, the reports focus on the key downstream sales and marketing agenda—helping to resolve the market challenges and identify future sales opportunities. Report content addresses market segmentation and also contains detailed reviews of PV incentive policies, PV project listings by segment (government, corporate and utility customers), downstream channel structure and volumes, financiers and PPA providers and terms, regional economics, downstream company activity and installed PV system pricing—concluding with a focus on the future via five-year market forecasts together with identification of short-term project-by-project order books.

To order Solarbuzz regional reports, contact us at our seven global locations, email us at contact@solarbuzz.com, or call Charles Camaroto at 1.516.625.2452 for more information.

About Solarbuzz

Solarbuzz, part of The NPD Group, is a globally recognized market research business focused on solar energy and photovoltaic industries. Since 2001, Solarbuzz has grown its client-base to include many of the largest global PV manufacturers, major investment banks, equipment manufacturers, materials suppliers, hedge fund companies, and a vast range of other multi-nationals. Solarbuzz offers a wide array of reports, including Marketbuzz, an annual global PV industry report, and Solarbuzz® Quarterly, which details both historical and forecast data on the global PV supply chain. The company’s research also provides annual downstream PV market reports by region for Europe, Asia Pacific and US markets. In addition, Solarbuzz.com is a recognized and respected online resource within the solar industry. For more information, visit www.solarbuzz.com or follow us on Twitter at @Solarbuzz.

Solarbuzz, part of The NPD Group, is a globally recognized market research business focused on solar energy and photovoltaic industries. Since 2001, Solarbuzz has grown its client-base to include many of the largest global PV manufacturers, major investment banks, equipment manufacturers, materials suppliers, hedge fund companies, and a vast range of other multi-nationals. Solarbuzz offers a wide array of reports, including Marketbuzz, an annual global PV industry report, and Solarbuzz® Quarterly, which details both historical and forecast data on the global PV supply chain. The company’s research also provides annual downstream PV market reports by region for Europe, Asia Pacific and US markets. In addition, Solarbuzz.com is a recognized and respected online resource within the solar industry. For more information, visit www.solarbuzz.com or follow us on Twitter at @Solarbuzz.

About The NPD Group, Inc.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit www.npd.com and www.npdgroupblog.com. Follow us on Twitter at @npdtech and @npdgroup.

The NPD Group is the leading provider of reliable and comprehensive consumer and retail information for a wide range of industries. Today, more than 1,800 manufacturers, retailers, and service companies rely on NPD to help them drive critical business decisions at the global, national, and local market levels. NPD helps our clients to identify new business opportunities and guide product development, marketing, sales, merchandising, and other functions. Information is available for the following industry sectors: automotive, beauty, commercial technology, consumer technology, entertainment, fashion, food and beverage, foodservice, home, office supplies, software, sports, toys, and wireless. For more information, contact us or visit www.npd.com and www.npdgroupblog.com. Follow us on Twitter at @npdtech and @npdgroup.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product

NATURE'S GENERATOR POWERHOUSE

Offers a maximum power output of 120V/240V 7200Watt and can power almost anything. Whether it is 120 Volts or 240 Volts, Powerhouse can single-handedly address all your home power requirements. The Nature's Generator is a solar generator built to be used anywhere, anytime. Power is supplied by our very own Power Panels and Wind Turbines, and can be connected to your home power. We ensure a clean charge without sacrificing any power, so you can stay connected wherever life takes you.