The current power trade between the United States and Mexico is relatively small, and the renewable sector in Mexico remains underdeveloped. Yet, encouraging market dynamics gives ample reason to pay attention to this area.

Peter K. Nance | ICF International

Executive Summary

The extensive reform under way in Mexico across all energy sectors has created a wave of anticipation and speculation about the future shape of the market and new opportunities for private investment. By opening their markets and modernizing their regulatory regime, Mexico’s leaders hope to invigorate lackluster hydrocarbon reserve additions and production while stimulating the country’s economic growth. This process will create significant potential opportunities for investment across all sectors. However, maximizing these opportunities while mitigating some of the risks and regulatory uncertainties will require close monitoring of the coming developments in rulemaking and market design.

In light of these developments, ICF International has developed a series of papers that highlight emerging issues in different aspects of the energy opening. In this paper, ICF examines the current opportunities and risks in cross-border renewables trade, especially for the California market.

The current power trade between the United States and Mexico is relatively small, and the renewable sector in Mexico remains underdeveloped. Yet, encouraging market dynamics give ample reason to pay attention to this area. California’s Renewable Portfolio Standard (RPS) goal is 33 percent from eligible renewable energy resources by 2020, but the state only has achieved 22.7 percent and even less in the Southern California market. Renewable resource estimates in Mexico are robust, including a potential of more than 10,000 MW of wind resource in Mexico’s Baja region alone—which already is interconnected with the Western Electricity Coordinating Council (WECC). The U.S. Energy Information Agency (EIA) recently indicated that Mexico is poised to become a fast-growing wind energy producer. Investments in renewable energy production in Mexico have previously benefited from a generous accelerated depreciation schedule. Given the country’s discussion of an ambitious new 35 percent non-fossil generation goal, generous investment incentives could continue to play a role under the new rules.

Whether this potential for cross-border growth is realized will depend on a number of factors. Wind projects located outside the California Independent System Operator (CAISO) control area must demonstrate adequate transmission capability, and current transmission capacity is constrained. California Environmental Quality Laws, Ordinances, Regulations and Standards (LORS) are extensive and require significant compliance work. In the coming year, questions must be resolved on the Mexican side of the border within its new regulatory framework, including the structure of capacity markets, energy banking, and permitting.

Overall, the available resources and growing demand may indicate an intriguing opportunity for developers that can successfully understand and navigate the emerging cross-border regulatory regimes.

Ambitious Reform Creates Opportunities and Lingering Questions

Mexico has embarked on a major reform of its energy sector. By ending a 75-year monopoly in oil and gas and creating new competition and regulatory incentives in power generation, the government hopes to re-invigorate three decades of relatively slow 2.4 percent average economic growth and to rapidly develop its abundant domestic resources.

In December 2013, Mexico’s Congress passed a constitutional amendment allowing partial privatization across all sectors. Although the state will maintain ownership and control of subsoil resources, private companies now will benefit from a licensing regime that is more likely to facilitate exploration and production, allow investment directly in the midstream and downstream sectors, and permit engagement in wholesale power generation. Pemex and CFE will continue to play a substantial role, but significant assets will be divested. The future direction of the market will be shaped through regulations promulgated by newly created government agencies and rulemakings rather than direct interventions.

The special session of the legislature currently under way to consider a package of sub-laws will have an enormous impact on how the market develops. Among the challenges faced by legislators are creating an adequate capacity market, streamlining permitting and interconnection agreements, and then standing up new regulatory agencies to administer the new rules within a year.

Three factors are broadly seen as encouraging signs of the future prospects of the reform:

- relatively timely development of the secondary legislation package—with only a 10-day delay beyond the constitutionally mandated 120-day timeline

- the balanced content of the new laws on issues like local content requirements

- increasing private investment opportunities

Major questions loom ahead. Perhaps the biggest of these questions is whether the agencies established under the new law can be fully functional before the proposed June 2015 timeline. In addition, human resource constraints are frequently mentioned as a broad concern for the sector. From a regulatory perspective, these constraints may impact whether the new National Safety and Environmental Protection Agency, the National Hydrocarbons Commission, and the Energy Regulatory Commission will be able to recruit the expert staff needed to regulate new activities.1 The mid-term elections in July 2015 also may complicate or delay the implementation of the new laws. Finally, major details on regulation remain unresolved, including the role of capacity markets in the electricity sector and what path will be taken to reach the country’s hydrocarbon fuel consumption target of 65 percent by 2024.

Current cross-border infrastructure and market trends provide a relatively clear picture of short- and medium-term prospects for hydrocarbon and power flows. The resolution of these regulatory questions in Mexico during the next 12 to 18 months will have significant ramifications for the scale and direction of long-term cross-border trade.

Current State of Electricity Trade and Renewables Development: Small But Poised for Growth

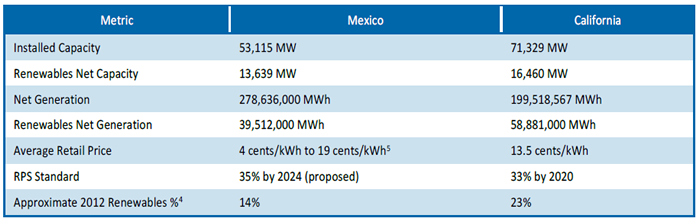

Fossil-fueled plants provide most of Mexico’s current capacity and generation. A relatively substantial renewables capacity exists (13,639 MW in 2011), but 85 percent comes from hydroelectricity, and only 1,993 MW comes from nonhydro generation. Mexico’s solar sector is particularly underdeveloped, with only 31 MW installed as of 2010, according to SENER’s 2012 Prospectiva del Sector Electrico.2 California’s renewables portfolio standard3 (RPS) also is dominated by hydro, although to a lesser extent, comprising about 60 percent of renewables capacity. Clearly, California’s 33 percent RPS goal by 2020, a mere five and a half years away, seems a long way off. Overall demand growth in the market renders this benchmark a moving goalpost.

Figure 1. Mexico vs. California Electricity and Renewables Comparison4

Between 2009 and 2014, the Mexican gas and renewable sectors have experienced substantial growth and this is expected to continue into the 2015–2020 timeframe. Early in the period, nationwide demand is expected to increase perhaps 2.7 percent annually and rise to perhaps 4.5 percent annually by 2020. Much of this increase is expected to result from the buildout of combined cycle generation driving total daily Mexican gas demand up 29% from 9.3 Bcf/d in 2015 to 12.0 Bcf/d in 2020. Mexican gas production fell from 5.4 Bcf/d to 5.1 Bcf/d from 2010 to 2013. ICF estimates that a third of total 2020 demand will be met through the supply of natural gas from the U.S.6 7

Three groups of interconnections exist between the grid in Mexico and that of United States – one centered on the California region, a second on Arizona, and a third centered on Texas. These provide some limited bidirectional commercial interconnections for cross-border electricity trade. Three commercially operational DC-ties form the group between the Electricity Reliability Council of Texas grid in Texas and CFE, with a total of 286 MW capacity; and two ties form the group located in California. The Mexico-California-Arizona interties are larger AC connections, with a total of 800 MW at the Miguel–Tijuana junction and Imperial Valley–La Rosita.8 Additionally, two small ties are from Arizona: an emergency 20 MW tie through a 34.5 kV line from Arizona to the Mexican state of Baja California and one serving 8 MW of load for industrial customers in the Sonora state in Mexico.8 Mexico has been a net exporter of electricity to the U.S. since 2003.

Opportunities for Exporting Central Station Renewables to Constrained Southern California

Several drivers point to strong potential for the development of Mexican renewables and export to Southern California.

Need in California

California’s RPS goal is 33 percent from eligible renewable energy resources by 2020. Many entities comprise the statewide market. With the use of its load as a proxy for Southern California, the Southern California Edison (SCE) had 21.6 percent of 2013 retail electricity sales served by renewable power. Statewide, the figure was approximately 22.7 percent.9 The California Public Utilities Commission (CPUC) lists 30 currently active RPS-eligible projects for SCE, with a minimum 3655 MW generating capacity. SCE’s overall demand is projected to rise from perhaps 100,000 gWh to around 113,000 gWh in moderate growth scenarios between 2012 and 2024. San Diego Gas & Electric demand will rise from about 20,000 gWh to 25,000 gWh.10 So clearly a gap must be filled in Southern California in the next five years and beyond. In the event of longer term, more aggressive RPS goals or a nationwide implementation of the Clean Power Plan and New Source Performance Standards, an even greater need will be created for substantial growth in local renewables generation. Whether this need can be met through additional distributed or community solar implementations in California, or even imports of wind or solar generation from other parts of WECC as currently contemplated, is unclear.

Resources in Mexico

Resource estimates show a potential of more than 10,000 MW of wind resource in Mexico’s Baja region, with several thousand MW found along the Juarez Mountains.11 Several wind projects are already in development in Baja and southern Mexico—in Baja, Sempra International is developing the Energía Sierra Juarez wind farm with an initial 156 MW first phase but a long-term plan for 1.2 GW. Based on these developments, the EIA recently indicated that Mexico is poised to become one of the world’s fastest-growing wind energy producers.12 On both sides of the border, according to the Renewable Energy Transmission Initiative, the aggregate of east San Diego County, Imperial County, and Northern Baja California has a potential solar generating capacity of 6,870 MW.13 Questions remain whether the Mexican market can absorb all of this potential in the near term.

Cross-Border Regulatory Conditions

Mexican lawmakers have tried to create the conditions for robust growth in renewables, including through the current energy banking program and other protocols that facilitate transporting and firming of renewables. The pending energy reform changes suggest an aspirational goal of 35 percent of electricity provided from non-fossil alternatives (renewable, hydro, and nuclear) by 2024. We anticipate more detail on this aspirational goal and possible developments after the secondary law framework is developed.

On the northern side of the border, a 2008 California Energy Commission study identified no statutory barriers that would limit the development and export of renewable energy to California, including the requirements of the North American Free Trade Agreement, U.S. Department of Energy, and Federal Energy Regulatory Commission.14 The resources that interconnect within WECC, as the Baja resources do, are already eligible under California RPS rules.15 Additionally, on the surface, renewable imports from Mexico appear compatible with the AB32 framework. Although not eligible for U.S. tax credits, investments in renewable energy production in Mexico have benefited from a generous accelerated depreciation schedule. This schedule allows 100 percent depreciation in the first fiscal year of equipment operation as long as the equipment continues to operate for a minimum of five years.16 Whether this exact incentive will continue under the new Mexican regulatory and tax incentive structure is unclear. ICF’s local partners believe that the country’s aggressive domestic “non-fossil” goal would seem to require robust financial incentives for buildout.

A potential regulatory advantage to expanded cross-border trade will exist if the Mexican regulation-writers can create a relatively smoother permitting process. High-profile examples such as the relatively tortured Sunrise Powerlink regulatory process in California, which extended more than five years, suggest an opportunity and potential for Mexican regulators to do better. Coordination with regulatory authorities north of the border to establish a streamlined and harmonized regulatory regime may be warranted if sufficient financial incentives exist. Although market and some regulatory conditions are positive, a number of serious regulatory challenges remain to be navigated.

Risk and Uncertainties to Resolve

Transmission Capacity Is Constrained

Under recent CPUC and California Investor Owned Utility (IOU) requirements, wind projects located outside the California ISO control area must demonstrate adequate transmission capability.17 The recent Presidential permit for Sempra International for construction, operation, maintenance, and connection of a 230-kilovolt (kV) transmission line across the U.S.-Mexico border to supply electricity from its Mexican wind farm to the California market is highly encouraging. However, current transmission capacity remains highly constrained.18

In addition to the requirement for a Presidential permit for exports, considerations include the need for an Environmental Impact Statement to support the application for a permit. Siting of transmission can be streamlined by determining whether the suggested changes are within National Electric Transmission Corridors. This type of designation is especially helpful in assessing how projects may impact federal and tribal lands, and holds potential to streamline the National Environmental Policy Act.

In addition, the process for getting approval of transmission interconnection in Mexico has been lengthy in recent years, taking one to two years for initial impact studies alone. The reform process is expected to place the process under the purview of El Centro Nacional de Control de Energía or CENACE which is widely expected to operate as an independent system operator (ISO); and, the Comisión Reguladora de Energía or CRE - the energy regulator. In Mexico, the right to export is managed by the CRE.

Meeting California Requirements

In the past, California RPS regulations have required an applicant for a facility outside of the United States to provide a comprehensive list and description of all LORS that would apply if the facility were located within California. The applicant must explain how it will meet these LORS and assess whether and how the facility would violate any of them. California’s LORS are extensive, including 16 distinct environmental considerations, among them land use, air quality, visual resources, paleontological resources, and biological resources—no small consideration for any developer. Moreover, developers have been subject to biennial recertification, the complexity of choosing a California county for baseline compliance analysis, and the regulatory risk of changing laws. Given that the regulatory structure in Mexico under the energy opening is still evolving, cross-border projects will require a sophisticated understanding of regulations on both sides of the border and detailed compliance work.

How Will Fine-Grained Details of New Mexican Regulations Be Resolved?

Mexico’s goal of displacing 35 percent of electricity energy supply with low-carbon sources (primarily renewables, hydro, and nuclear) within 10 years is widely discussed. Substantial differences exist among major stakeholders in Mexico about how realistic and affordable this view may be. Conversations with former executives of CFE and PEMEX suggest that the marginal cost of the final 3 percent to 5 percent toward that goal may be so high that the overall target may ultimately be reduced. Even with this type of compromise, how much effort will actually be made to meet even a reduced benchmark is unclear. Also unclear is whether the target will remain mostly aspirational, an outcome that seems far more likely. A “firmer” domestic target with a more detailed and robust framework could undermine the comparative financial incentive to build for the California market. We anticipate more details later this year once the secondary laws are developed.

ICF currently takes the view that sensitivity to price impacts will tamp down renewables buildouts and limit their contribution. Also important to consider is the systemwide reserve margin of 29 percent in 2013, according to ICF estimates. However, the final renewables benchmark level and associated incentives to meet any target will depend on the results of negotiations yet to come in the U.S. Congress. These results could alter the dynamics for the coming years. Conceivably, some policy designs might significantly reinforce renewable developments in Mexico. Continuation of depreciation treatment for domestic-oriented projects represents one possible approach. However, whether this treatment would be applied to export-oriented projects or projects that serve domestic and export goals must be resolved.

In the United States, the extension of Production Tax Credits (PTCs) for wind and solar projects also would appear to disadvantage imports from Mexico. However, the effect of including wind and solar renewable projects in recently discussed Master Limited Partnership structures may be less clear. The structure of and experience with existing Canadian and U.S. vehicles also may prove instructive.

Is the California-Baja Border the Appropriate Focus for Cross-Border Development?

Because of the environmental, permitting, and regulatory complexities involved in electricity planning, is a cross-border solution involving a larger area is more appropriate? Recent developments indicate that the answer might be yes.

In 2013, the Arizona-Mexico Commission Energy Committee issued a report entitled Bi-Lateral Electricity Transmission Opportunities for Arizona and Sonora.19 The report examined the history of and possibilities for greater cross-border integration of electricity infrastructure in the southwest.

In the report, one particularly striking feature was the proximity of the Sonoran solar resource potential to major demand centers in Tucson and Phoenix, AZ. Coupled with the substantial resource base defined in Arizona and substantial transmission capacity and corridors already existing between Arizona and California, a re-envisioned transmission plan might look differently in the future.

The study touched on the potential for cross-border renewable development that was substantial. However, many of the identified benefits were in the areas of cost savings from greater integration of the Arizona and Sonora grids. Consequently, we will examine these benefits in greater detail in a related paper dealing directly with conventional power generation.

Conclusion

The combination of market growth and evolving regulations creates potential opportunities for investment in renewables for export as well as domestic Mexico consumption. One scenario is that all of these near-term regulatory and economic dynamics may incentivize buildout of Mexican renewables with an initial eye toward the California market (and potentially the California Independent System Operator [CAISO] capacity payments if that market were to be revised). If these renewable commitments could be structured under relatively shorter term 10-year power purchase agreements, or a longer term agreement with an embedded option to recall power early in return for a pre-negotiated “buy-down” clause, such an approach might meet the needs of investors and financial institutions. The approach would also provide flexibility in the medium-term to redirect supplies as the domestic market in Mexico matures. If sufficient transmission upgrades can be appropriately conceived and completed in Mexico, overall development costs on both sides of the border could be reduced. Such a reduction could provide additional flexibility to scale additional facilities and to match better with local demand growth in Mexico.

Questions linger about how Mexican legislators must work to resolve these issues. Potential investors will want to closely monitor the legislative process. The biggest question is whether in general, these market dynamics, including the near-term demand for electricity and especially for renewables to fulfill RPS goals in California, are sufficient to overcome the regulatory complexities and create enough of a gradient to provide incentive to invest in a northward flow of renewable energy.

References

- Suggested by “Opening Mexican Energy: Encouraging Signs from the Government’s Secondary Legislation Package” dated 05/02/14 at 2:38p,

- SENER, Prospectiva del Sector Eléctrico 2012-2026, published 2012,

- Biennial RPS Program Update dated February, 2014, and related supporting documents

- All data from EIA reflects 2012 figures. Mexico data are from the International Energy Statistics page ; capacity data are 2011;. California data are from the State Renewable Electricity Profiles page dated March 8, 2012

- Sources: ICF and EnergeA. Wide variation exists in retail rates based on subsidies for different consumer classes. Commercial users pay the most, residential consumers pay about 10 U.S. cents/KWh, and agricultural sector customers pay the least. Figures reflect 2011 data at 2011 end-of-year currency conversion rates.

- Historical data from SENER Prospectiva del Sector Eléctrico 2012-2026, published 2012, . Projection – ICF International

- Descriptions from ERCOT: DC Tie Operations v3.0 R8, published March 14, 2014.,

- Arizona-Mexico Commission Energy Committee, “Bi-National Electricity Transmission Opportunities for Arizona and Sonora”, June 14, 2013,

- Biennial RPS Program Update dated February, 2014, and related supporting documents

- California Energy Commission , Draft Staff Report, “California Energy Demand 2014-2024 Preliminary Forecast - Volume 2: Electricity Demand by Utility Planning Area, May, 2013,

- California Energy Commission, “Challenges And Opportunities To Deliver Renewable Energy From Baja California Norte To California”, June, 2008,

- EIA Country Profiles - Mexico, April 24, 2014,

- Renewable Energy Transmission Initiative, Phase 2A, Final Report, September, 2009,

- California Energy Commission, “Challenges And Opportunities To Deliver Renewable Energy From Baja California Norte To California”, June, 2008,

- California Energy Commission, Staff Final Guidebook, 7th Edition, “Renewables Portfolio Standard Eligibility”, April, 2013,

- California Energy Commission, “Challenges And Opportunities To Deliver Renewable Energy From Baja California Norte To California”, June, 2008,

- California Energy Commission, “Challenges And Opportunities To Deliver Renewable Energy From Baja California Norte To California”, June, 2008,

- EIA Country Profiles - Mexico, April 24, 2014,

- Arizona-Mexico Commission Energy Committee, “Bi-National Electricity Transmission Opportunities for Arizona and Sonora”, June 14, 2013,

About the Author

Peter K. Nance is a Principal in ICF International’s Energy and Aviation Markets Division. He has extensive experience with institutional reform, examining major trends in the energy sector, and helping clients develop new business offerings using strategic planning and market analysis to effectively leverage their real competitive advantages. He has directed more than 200 consulting projects in strategic planning, commodity trading and marketing, risk management, and financial strategy. He has with experience in business and project development; market design; market supply and demand assessment; business and integrated resource planning; and financial and economic evaluation in the oil, natural gas, and power sectors.

About ICF International

ICF International (NASDAQ:ICFI) provides professional services and technology solutions that deliver beneficial impact in areas critical to the world’s future. ICF is fluent in the language of change, whether driven by markets, technology, or policy. Since 1969, we have combined a passion for our work with deep industry expertise to tackle our clients’ most important challenges. We partner with clients around the globe—advising, executing, innovating—to help them define and achieve success. Our more than 4,500 employees serve government and commercial clients from more than 70 offices worldwide. ICF’s website is www.icfi.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product