Acquisition activity in Q3 2014 was lower than most quarters in recent history. Activity was distributed relatively evenly across the solar markets in Europe, North America and Asia, with cross-continental deals accounting for the greatest number of transactions.

Q3 2014 Deal Volume Comparison

Reprinted with permission from | Lincoln International

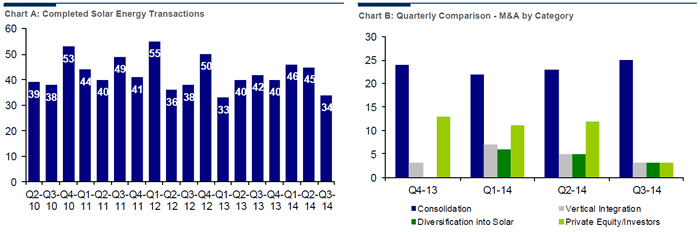

There were 34 completed solar energy transactions in Q3 2014 compared to 42 in Q3 2013. This represents a decrease of 19% year over year, and continues the declining trend from the prior quarter. The past seven quarters have averaged approximately 40 transactions each, which is still a robust level of activity.

Within the solar energy transaction activity, consolidation represented 73% of transactions, or 25 deals in Q3 2014. This is the largest share by any category in a quarter over the past several years and exhibits the continued maturity of this industry through consolidation. The remaining three categories, vertical integration, diversification into solar and private investment, each represented 9%, or 3 transactions in Q3 2014.

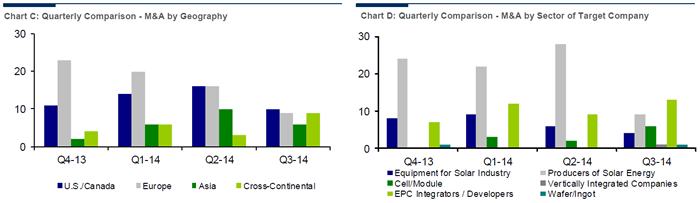

From a geographic perspective, 29% or 10 of the 34 transactions during Q3 2014 occurred in the U.S./ Canada region. Cross-continental and European deals each accounted for 9 transactions, or 26% of the total. Asia accounted for 6 transactions, or 18% of the total. South America did not record any transactions this quarter.

The EPC integrators/developers category of target companies led transaction activity during Q3 2014 with 13 deals, or 38% of the total. There were 9 acquisitions of producers of solar energy, or 26% of the total transaction volume. There were 6 transactions for cells/modules companies, or 18% of total activity. Companies categorized as providers of equipment for solar accounted for 4 transactions, or approximately 12% of the Q3 2014 total. Companies categorized as wafer/ingot producers and vertically integrated companies each recorded one transaction during the quarter.

Acquisition activity in Q3 2014 was lower than most quarters in recent history. Activity was distributed relatively evenly across the solar markets in Europe, North America and Asia, with cross-continental deals accounting for the greatest number of transactions. EPC integrators/developers replaced producers of solar energy as the primary targets for acquisition, with the remaining balance of transactions fluctuating between the other categories. Regardless of target category, a large proportion of deals were the result of industry consolidation as smaller companies and projects were acquired by established players. The high level of consolidation activity highlights the maturation in the solar industry as companies look to build scale, vertically integrate and grow their solar project portfolios through acquisition.

Announcements

- SolarCity Corporation (NasdaqGS:SCTY) acquired Silevo Inc. (Sept.-14)

- NRG Energy, Inc. (NYSE:NRG) acquired Goal Zero, LLC (Sept.-14)

- Trina Solar Limited (NYSE:TSL) acquired a 50 MW solar site from Good Energy Group plc (Aug.-14)

- SunEdison, Inc. (NYSE:SUNE) acquired Silver Ridge Power Inc. from AES Corporation (NYSE:AES) (July-14)

Margin Performance in the Solar Energy Industry

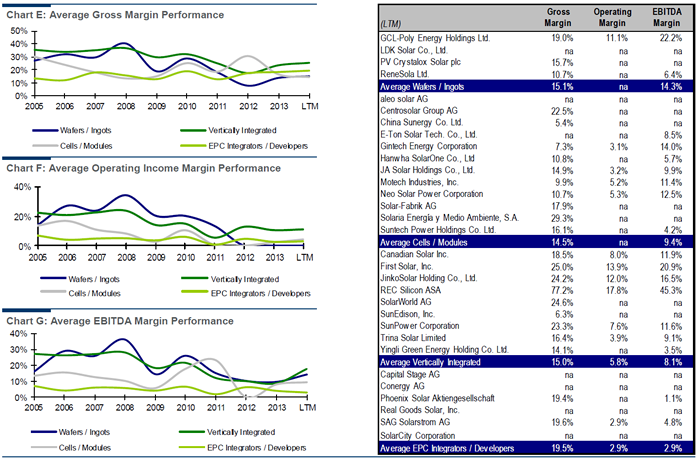

The majority of sectors within the solar energy industry are still exhibiting lower than optimal bottom line margins. However, certain sectors are now beginning to see slight margin improvements from industry consolidation, continued growth for solar in certain geographies and benefits from vertically integrated models.

The three graphs below provide an overview of gross margin, operating income margin, and EBITDA margin performance from 2005 through today. Each graph shows the margin performance by sector within the solar energy industry.

In terms of margin performance, vertically integrated companies saw improvement in gross, operating and EBITDA margins in LTM Q3 2014. The wafers/ingots companies saw increasing gross and EBITDA margins compared to their Q3 2013 LTM levels. The cells/modules companies saw increasing operating and EBITDA margins yet decreasing gross margins as compared to this time in 2013. Finally, the EPC integrators/ developer companies saw increasing gross margins and operating margins, yet decreasing EBITDA margins as compared to a year ago.

Overall, vertically integrated companies exhibited the most consistent margin improvement over the last year. This could indicate that the integrated model is beginning to bear fruit as companies are realizing the scale and cost benefits from being integrated across the value chain.

About Lincoln International

Lincoln International specializes in merger and acquisition advisory services, debt advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With sixteen offices in the Americas, Asia and Europe, Lincoln International has strong local knowledge and contacts in key global economies. The firm provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product