With the removal of fossil fuel subsidies and the continual drop in capital costs in renewables technology, the margins for the leading players in the renewables industry will increase.

Bonaire Le | Nexant

Over the past seven months, the drop in the crude oil price has generated uncertainty among petrochemical stakeholders, with many planned projects postponed and financing bodies unsure about the extent and future impact on financial returns. For the petrochemical industry, there is an inherent relationship between crude oil as a primary raw material and downstream petrochemical derivatives. However, the impact of crude oil on an adjacent sector like renewable energy is less defined. Factors such as legislative mandates, competitive substitutes, and varying regional impact must also be considered. The following analysis presents a discussion of these elements, concluding that:

- The dependency on crude oil for power generation has been decreasing, diminishing its impact on the economic competitiveness of renewable energy while increasing the need to assess renewables against alternatives such as natural gas, coal, and nuclear.

- Crude oil’s drop in price has highlighted the attractiveness of renewable energy’s relative isolation from fuel-price fluctuations. The certainty in up-front capital costs and “zero” raw material costs is favorable and inherently lower-risk when compared to petrochemical-based projects where forecasted project ROI is dependent on the accuracy of raw material forecasts.

- The removal of fossil fuel subsidies and the continual drop in renewable technology capital costs will increase the margins captured by leading players in the renewables industry. A possible tipping point may be reached where fossil fuel-based power will in turn be set by the cost of solar or wind energy.

Getting to below $60 per barrel

The price of crude oil (Brent) fell by 50 percent from approximately $110 per barrel in July 2014 to $50–55 per barrel in March 2015. Due to current levels of production resulting in global oversupply, crude oil continues to trade around $60 per barrel – the lowest it has been since 2009. Some market analysts predict a fast market rebound by early 2016, while others anticipate a much slower recovery (three to five years). Oil prices may even fall further in 2015 before any positive signs of recovery – possibly reaching prices below $40 per barrel. Stepping aside from market predictions, it is important to return to the fundamentals of why crude oil fell in 2014 before drawing any conclusions on market recovery and, more broadly, the renewable energy market.

In the mid-2000s, global demand for crude oil was rising – particularly in China – with production lagging behind. This situation resulted in a tight market and steep price increases. Due to the increase, many companies tracking the energy returned on energy invested (EROEI = Usable Acquired Energy / Energy Expended) for oil production found it profitable to begin extracting oil from difficult-to- drill locations. As the US has extensive resources of this type, during 2008 to 2012, it was able to add about 4 million new barrels per day (bpd) of crude oil (deep sea as well as shale) to the global market.

US shale production grew but oil prices did not decline due to geopolitical conflicts in key oil-producing regions of the world, limiting the volume of crude oil accessible by the global market. The civil war in Libya impacted its regional production, while tensions in Iraq continued. The US imposed sanctions on Iran’s Central Bank at the start of 2012 and sanctions on insurance and transportation in Iran’s oil sector in mid-2012. Additionally, the European Union continued to expand its sanctions, targeting Iran’s energy sector. These geopolitical issues resulted in approximately 3 million bpd of crude oil being taken off the market. As a result, from 2011 to early 2014, the price of crude oil hovered around $100 to $110 per barrel and the market became comfortable with relative price stability.

In 2014, the Organization of the Petroleum Exporting Countries (OPEC) – responsible for supplying 40 percent of the world’s crude oil – increased its oil production by the largest volume in almost three years. Libya more than doubled its production (from around 250 000 bpd to 787 000 bpd) and Iraq increased its production from 3.16 million bpd to approximately 3.60 million bpd. Saudi Arabia also reported increased production (of over 100 000 bpd) to a total of 9.7 million bpd. In total, OPEC introduced incremental volumes of over 0.8 million bpd to the market. Meanwhile, the US continued to increase its shale production. As a result, the global production increased faster than demand, creating a long market.

Global growth in crude oil demand was weak prior to 2014 from slowing economies in China and Europe. Due to the increase in oil prices and limited supply in 2000 to 2010, countries placed a concerted effort on reducing dependence on crude oil. Countries sought to diversify their energy portfolio by setting energy targets to reduce oil consumption and increase investments in alternative energy. Energy efficient and electric/hybrid vehicles (e.g. Nissan Leaf, Toyota Prius, and Tesla) gained consumer popularity and market share. Residential solar installations started to gain popularity. As technologies advanced (decreasing the magnitude of capital investment) and countries developed know-how, their demand for crude oil slowly decreased. Renewable energy and technologies gained footing as a viable energy alternative.

With tepid demand in crude oil and rising supply from OPEC and the US, crude oil prices started to drop. OPEC has reported that it does not plan to cut production in order to boost oil prices (and some argue that doing so would result in the US increasing its oil production further to capture a larger market share, which would be unfavorable to OPEC). While the drop in crude oil prices can be tied to several factors, the current (and prolonged) state of the market and pricing of crude oil appears to be partially driven by a political play for market control. As a result, the price of crude oil has remained low, fluctuating around $60 per barrel .

Historic correlation and modern divergence

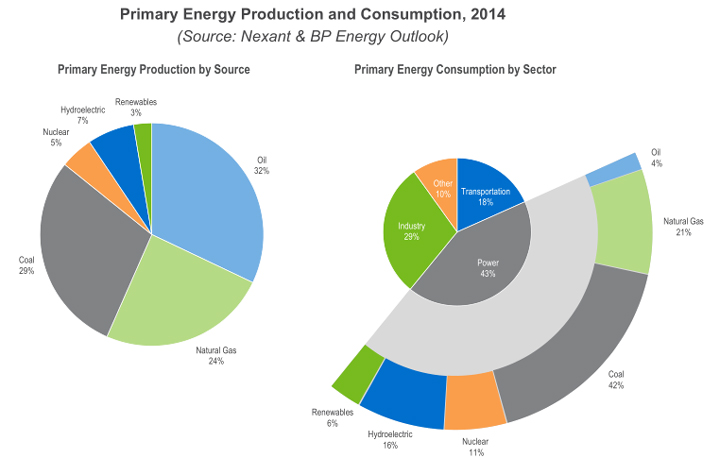

The economics of renewable energy are a balance between public policies (e.g. subsidies, legislation, etc.) and the availability and pricing of alternative energy sources (e.g. crude oil, natural gas, coal, etc.) – which should be separated into the direct/primary influence of crude oil prices and the secondary influence of market perception. In 2008 and 2009, an analysis of the correlation between the share price of solar companies and the price of crude oil resulted in an R-value (correlation coefficient) of .89 to .96. 1,2 Prior to 2010, the average correlation of solar companies and crude oil fluctuated around an R-value of 0.7. 3 However, this correlation has broken down over the previous years. Broadly speaking, crude oil and renewable energy sources are used to satisfy different parts of global energy demand. In 2014, 43 percent of all primary energy sources – crude oil, coal, gas, nuclear, hydroelectric, and renewables – was used as an input to power generation of which, only five percent was accounted for by crude oil. While crude oil remains one of the largest primary sources of energy, it is principally used to produce transportation fuels, while renewable energy is used to generate power (e.g. electricity). Crude oil and renewable energy are not direct substitutes, and therefore when the price of one increases, the demand for the other does not also increase. The exception to this comparison is liquid transport bio-fuels – e.g. bio-diesel, bio-jet fuel, and bio-ethanol – which directly compete with crude oil products. In this case, the drop in crude oil prices will have a direct impact as bio-fuels compete directly with petro-fuelled cars, which become cheaper to operate as oil prices fall.

The observed historic correlation between crude oil and renewables primarily results from the secondary influence of market perception. Too often the price of crude oil is used as an all-encompassing indicator for the health of energy markets. While it is true that oil continues to be the largest single source of global primary energy (approx. 32 percent in 2014), natural gas and coal are also major resources (accounting for around 24 percent and 29 percent, respectively). The incomplete (or, perhaps, overly broad) association between crude oil and renewables can create an environment of disincentives for policymakers, project lenders, and private investors, resulting in unfounded political and financial repercussions. Stakeholders and spectators of the renewable energy sector should consider the weight of factors like legislation or geographic availability, which have a more significant impact on the outlook of renewable energy than oil prices.

A complete picture of renewable energy markets considers the competitiveness of renewable sources like solar and wind against other primary fossil fuels (e.g. coal and natural gas), within the context of power generation. While oil-fired power generation has previously been a key contributor to power supply, its relative importance has diminished over the past 40 years, favoring natural gas, coal, and (in some regions) nuclear. In fact, coal and natural gas – accounting for over 40 percent and 20 percent of power production in 2014, respectively – are forecast to maintain their stronghold of the global energy market throughout the foreseeable future, while solar and wind energy are also expected to grow from a market share of five percent in 2014 to almost 15 percent in 2035. Including hydroelectric power, renewable energy may account for around 35 percent of global power generation by 2035.

With the prices of crude oil and natural gas decoupling over the past 5 years, natural gas has become a strong competitor for renewable energy in the power sector. The widening price spread between gas and crude oil has led to increased interest in gas-for-oil substitution opportunities. Power generation from natural gas benefits from low capital costs, variable (but low) fuel cost, and less than half the carbon impact of coal-generated power. However, opportunities exist for the integration of natural gas and renewable energy such as hybrid technologies (e.g. hybrid concentrated solar power and natural gas-fired power generation systems), system integration (e.g. co-optimization of grid response systems to energy demands), and power sector market design (e.g. joint diversification of energy sourcing). Still, natural gas and renewable energy markets are strongly influenced by geopolitical challenges.

As the dependency on crude oil for power generation continues to decrease, price fluctuations from this resource will have a diminishing impact on the economic competitiveness of renewable energy. An analysis on the availability of renewable energy pricing alternatives against natural gas, coal, and nuclear has demonstrated a growing influence of these fuels on the economic viability of sources like solar and wind. The competitiveness of renewables, of course, is expected to vary based on geographical context. Moving beyond the historic correlation between crude oil and renewable energy (and turning focus towards the relative economics of renewable energy against all primary resources) allows for a more robust analysis of the energy market.

A renewed opportunity for renewables

Traditionally, renewable energy has been largely driven by sustainability targets and concerted regional efforts to diversify existing energy portfolios. Subsidies have made solar PV economically attractive and viable for many consumers, resulting in unprecedented growth over the past decade. Global installations have continued to rise since 2006, largely driven by the continued drop in capital costs – the price of PV modules has fallen by over 30 percent year on year since 2008. This reduction in capital investment has allowed solar power to be viewed as a viable energy alternative to traditional power generation from coal, natural gas, and/or nuclear. Countries in the Middle East have included solar as part of their investment into a wider energy portfolio, a possible option in their “post-oil” future. For most countries (with the exception of some in Western Europe and South America), renewable energy continues to be viewed as an energy alternative within a wider portfolio where coal and natural gas play leading roles. The drop in crude oil prices has caused many nations to reconsider the allocation of their current subsidies (both towards renewables and towards fossil fuels), which has presented an opportunity for renewable energy to transition from an energy alternative and into an energy staple. With crude oil prices cut by more than half, at least 27 countries have elected to decrease or end subsidies that currently regulate fuel costs for electricity generation (including coal and natural gas). 4 Fossil fuel subsidies have previously been criticized for distorting the energy markets in favor of sources that, without their support, would not be economically viable. The IEA has reported that the nations providing the most generous aid include: Iran, Saudi Arabia, India, Russia, Venezuela, Egypt and Indonesia. The impact of these reductions on nations like the US and the UK are much less apparent, however, where special tax treatments are still provided to oil drillers in the Gulf of Mexico and the North Sea (and therefore subsidies are not administered).

The recent price drop in crude oil has highlighted the attractiveness of renewable energy’s relative isolation from fuel-price fluctuations. While wind and solar energy plants require intensive upfront capital, their forecasted project ROI is not dependent on the accuracy of raw material forecasts (as necessary with petrochemical projects), since resources like wind and sun have an input cost of “zero”. The experienced volatility in prices has demonstrated that investing in crude oil is an increasingly risky strategy. By comparison, the payback of solar projects is determined based on the levelized cost of energy (LCOE), which calculates the cost of building and operating the plant over an assumed lifespan. As larger commercial investors become more comfortable with the risks associated with long-term ownership of solar assets (e.g. the uncertainty of weather), they will be increasingly willing to underwrite debt positions where the cost of capital is lower than experienced with traditional power project financing.

The financing of renewable energy projects through LCOE analysis places a heavy emphasis on the upfront capital costs, which are much easier to estimate and, more importantly, are decreasing with advancements in technology. As renewable energy is a technology dependent sector (and at this stage of the experience curve), costs will continue to decrease with the refinement and improvement of manufacturing methods, installation techniques, and development of know-how. Fossil fuels, on the other hand, are an extraction-dependent sector, where costs increase as resources become harder to find. Arguably, fossil fuels stand to benefit from technology gains and cost deflation as well, but technology development for drilling and extraction is often slow and limited. This differentiation between technology-based and extraction-based industries is a critical point to communicate to potential investors. With dropping module prices in solar energy and progressing research towards energy capture and storage, renewable energy could leverage the opportunity spurred on by the current state of crude oil to depress or possibly reverse further penetration of conventional power sources.

The “so what” of technology development and policy

National policies as well as technology costs have significant implications on the economic competitiveness of energy from sources like wind and solar. The decreasing capital costs of renewable energy projects (e.g. the significant drop in module prices for solar PV) have resulted in the ability for some projects to operate at grid parity without the need for any renewable energy subsidies. The drop in oil prices has highlighted an opportunity for solar and wind to leverage capital cost reductions and technology developments in order to increase market penetration. In particular:

- The further removal of fossil fuel subsidies could potentially drive renewable energy technologies to reach a strong competitive position against their fossil fuel-based alternates for power generation.

- While module costs for solar PV continue to fall, additional technology efficiencies associated with installation, energy storage, and services could have an even larger impact on the economic viability of solar technology.

- Improvements in energy capture and storage technologies, in particular, will have the largest impact on wind and solar power, overcoming issues associated with intermittency and distribution.

The success of renewable energy sources like solar and wind no longer depends solely on the technology and regulation surrounding implementation. Key stakeholders in the industry need to consider and negotiate innovative business models to drive the evolution of energy markets, particularly with regards to the integration of solar and wind with existing infrastructure.

Off-grid areas and isolated-grid areas have different requirements from well-developed regions where extensive grids manage electricity demand for peak and off-peak operations. As such, business models should be tailored to each customer segment.

- Off-grid and isolated-grid areas are most conducive towards a distributed energy model, which is easily provided by solar and wind.

- Large-scale renewable energy power fields are well-placed in emerging markets where infrastructure is currently expanding.

- Robust mechanisms need to be in place for commercial or residential tie-ins to the grid. Renewable energy business models in countries like Costa Rica, Iceland, and India will be different from those in Spain, Germany, and the United Kingdom.

The volatility in oil price has additionally underlined the necessity to weigh the risks of fossil fuel-based projects (which are subject to raw material pricing uncertainties) against the risks of renewable energy-based projects (where raw material costs are essentially zero, but long-term risks such as the unpredictability of weather are of concern). This venue is where the continual evolution of financial policy and financing mechanisms could have a large impact. There is a growing interest for low-cost financing in remote areas (e.g. off-grid or isolated-grid locations especially in non-OECD regions). However, as these geographies are typically associated with high risk, it is often difficult for larger financing institutions to rationalize the upfront capital costs to purchase the technology and to install the systems.

As part of the energy mix, renewable energy will continue to be evaluated against its counterparts. Historically, prices for solar-based power were set by the price of fossil fuels. However, with the removal of fossil fuel subsidies and the continual drop in capital costs in renewables technology, the margins for the leading players in the renewables industry will increase. It is possible for a tipping point to be reached where fossil fuel-based power will in turn be set by the cost of solar or wind energy. For this to happen, both upstream and downstream players will need to continually refine and advance technology to reduce capital costs while increasing operational efficiency. Manufacturers may need to specialize or develop proprietary technologies (as seen with petrochemical technology licensors). Financing bodies will continue to shift towards altered debt positions, with higher upfront capital costs and long-term risks. Novel business models will be developed to target specific customer segments. All of these efforts will transition renewable energy from being an energy alternative towards being an energy staple.

1 This correlation translates to a relationship in the pricing movements of crude oil and the market share price of solar companies, where 80 – 90 percent of the time an increase in crude oil price would match an increase in the market price of a solar company. By comparison, a multinational grocery and/or merchandise retailer has an R-value of around .60 (i.e., 60 percent of the time the gains or losses in share price of the company would mirror the movement of crude oil prices).

2 Impact of Oil Price on Solar Industry, 2013, Green Rhino Energy (www.greenrhinoenergy.com)

3 Why Solar is Correlated With Crude, 01 Dec 2014, Seeking Alpha (www.seekingalpha.com)

4 Countries that have (or plan to) cut subsidies for fossil fuels include Germany, Morocco, Mexico, Egypt, and Malaysia.

Bonaire Le

Consultant, Energy and Chemicals Advisory

Bonaire is a consultant within Nexant’s Energy and Chemicals Advisory Services Unit. Based in London, he works with regional and multinational clients across Europe, Middle East, and Africa on a range of projects – from technical and commercial due diligence to transaction and strategy assignments.

About Nexant Inc.

Nexant is a globally recognized software, consulting and services leader that provides innovative solutions to utilities, energy enterprises, chemical companies and government entities worldwide. Founded in 2000 and headquartered in San Francisco, Nexant and its 650+ employees work from 31 global offices providing deep technical expertise and regional knowledge to improve customer engagement, boost operational efficiency, reduce costs and achieve superior business results.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product