There were 20 completed solar energy transactions in Q3 2016, which represents the same number of transactions recorded in Q2 2016.

Q3 2016 Deal Volume Comparison - Lincoln International

Contributed by | Lincoln International

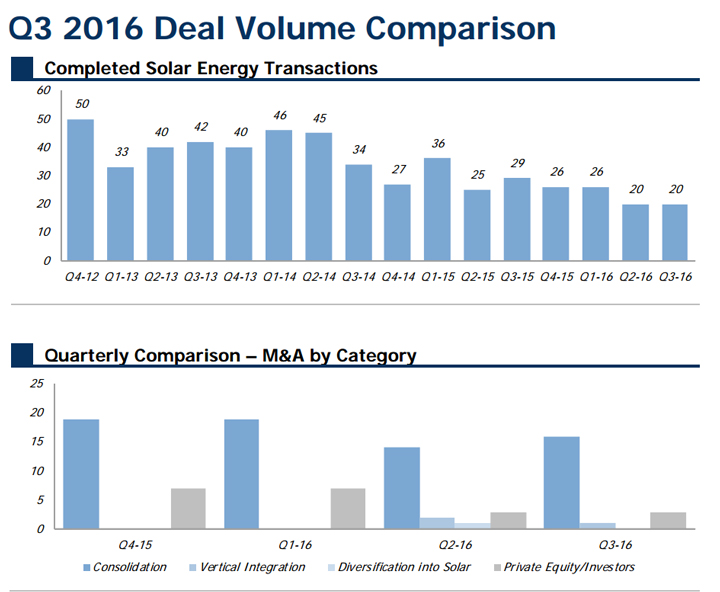

There were 20 completed solar energy transactions in Q3 2016, which represents the same number of transactions recorded in Q2 2016. On a comparative basis, this represents a decrease from the 29 transactions reported in Q3 2015.

Within the solar energy transactions, consolidation represented 80% of M&A activity, or 16 deals in Q3 2016. The next largest category was investment by private equity/investors with three transactions, or 15% of the deals in Q3 2016. There was one transaction categorized as vertical integration this quarter. There were no transactions categorized as diversification into the solar industry.

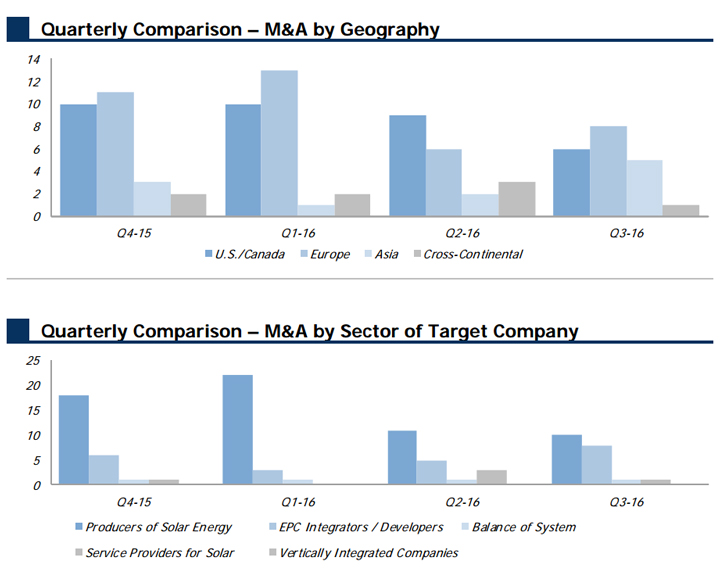

In Q3 2016, 40% or 8 of the 20 total transactions occurred in Europe. This represents a 10% increase in M&A activity in this geography from Q2 2016. The U.S. and Canada recorded six transactions, or 30% of the Q3 2016 total. Asia recorded five transactions, or 25% of the total in Q3 2016, while cross-continental deals accounted for one transaction, or 5% of the Q3 2016 total. South America did not record a solar energy transaction this quarter.

In addition, there were 10 acquisitions of producers of solar energy (this category includes acquisitions of solar projects), or 50% of the total. There were 8 acquisitions of EPC integrators/developers, or 40% of the total transaction volume. Acquisitions of companies categorized as service providers for solar accounted for one transaction, or 5% of the Q3 2016 total. Acquisitions of solar companies categorized as balance of system providers also accounted for one transaction (5% of the total) in Q3 2016. There were no acquisitions of vertically integrated solar companies.

Consolidation for producers of solar power continued to be the primary source of deal activity, in addition to continued volume from the private equity/investors category.

An Analysis of Global Solar Energy Trends

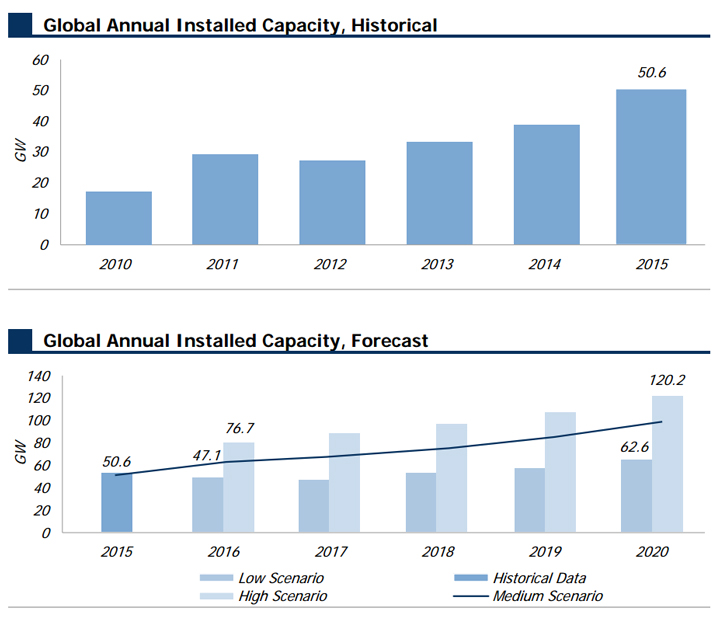

Solar market growth remained strong in 2015, continuing the positive growth trajectory established over the past few years. The market increased as solar is continuing to become a larger source of power generation, surpassing 225 GW of cumulative installed capacity globally in 2015.

In 2016, the market has continued to grow and could see a major increase in solar installation numbers globally. Moving forward, growth in demand is expected to be driven by price decreases for the balance of solar systems and the development of previously untapped markets. This trend is demonstrated in the Global Annual Installed Capacity Forecast chart on the following page, where after a potential slowdown in 2017, the solar industry is expected to return to steady expansion for the long-term.

Europe has traditionally dominated the solar market, but the rest of the world continues to catch up at a rapid pace. Growth in Europe is expected to remain robust, with total installed capacity reaching as high as 170 GW in 2020, a ~75% increase compared to today’s market. Outside of Europe, the market is well-balanced. China, Japan and the United States are leaders with great potential for future growth. By the end of 2015, China had 43.4 GW of cumulative installed PV capacity due to strong political support and feed-in tariff based policies. Japan and the United States also continue to benefit from favorable government support, with 34.3 GW and 25.9 GW of cumulative installed PV capacity, respectively, by the end of 2015. These geographies were followed by developing countries that are expected to represent strong geographies for solar growth in the future.

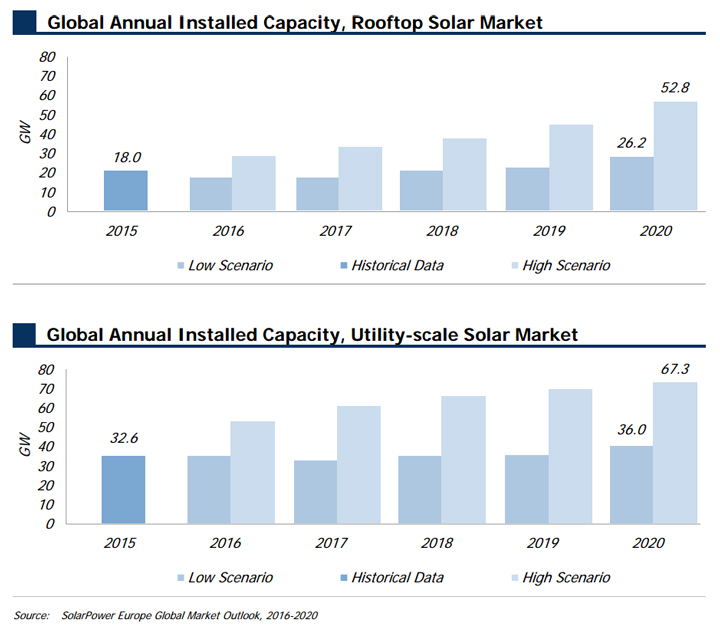

Currently, the split between rooftop and utility-scale solar installations is slightly weighted toward the utility-scale segment. Going forward, utility-scale plants are forecasted to exhibit faster growth globally. In certain markets, such as the U.S., rooftop projects are expected to experience faster growth as solar leasing programs and other financing structures provide more availability to residential and small commercial projects.

About Lincoln International

Lincoln International specializes in merger and acquisition advisory services, debt advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and joint venture and partnering advisory services on a wide range of transaction sizes. With eighteen offices in the Americas, Asia and Europe, Lincoln International has strong local knowledge and contacts in key global economies. The firm provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product