Solar market growth slowed in 2012, after setting a record pace in 2011. While the market stabilized solar is still becoming a larger source of power generation, expected to surpass 100 GW of cumulative installed capacity globally this year.

Lincoln International's Solar Energy DealReader: Q1 2013

Contributed by | Lincoln International

Q1 2013 Deal Volume Comparison

.jpg)

There were 33 completed solar energy transactions in Q1 2013 compared to 55 in Q1 2012. This number is a decline from the 50 transactions recorded in Q4 2012, but is generally in line with Q2 and Q3 2012 levels. While the volume of transaction activity has declined from the previous quarter, the level of deal activity remains robust as the industry continues consolidating. Within solar energy transactions, consolidation represented 52% of transactions, or 17 deals in Q1 2013. The next largest category was investment by private equity/investors with 14 transactions, or 42% of the Q1 2013 total. Diversification into the solar energy industry by corporations and investors accounted for two transactions, or 6% of the total, while vertical integration did not report any transactions in the quarter.

In Q1 2013, 45% or 15 of the 33 total transactions occurred in Europe. This represents a 9% decrease in share from Q4 2012. U.S. / Canada exhibited a slight decrease in activity recording 10 transactions or 30% of the total in Q1 2013, but a greater share of transactions than the previous quarter. Crosscontinental transactions accounted for six transactions, or 18%, which is the same number as the previous two quarters. Additionally, Asia recorded two transactions during Q1 2013 which represented 6% of the total. South America did not record a transaction.

In addition, there were 17 transactions for solar energy producers, or 52% of the total, which is about half as many as the 32 recorded in Q4 2012. This quarter there were eight acquisitions of cells / modules producers, or 24% of the total transaction volume. There were six transactions for companies categorized as EPC integrators / developers, or 18% of total activity, while companies categorized as providers of equipment for solar accounted for two transactions, or 6% of the Q1 2013 total. No transactions categorized as wafer / ingot producers or vertically integrated companies were recorded during the quarter. After a spike in Q4 2012, acquisition activity returned to normal levels in Q1 2013. Consolidation for producers of solar power continued to be the primary source of deal activity, in addition to significant volume from the private equity / investors category. Activity remained significantly weighted to the more established markets in Europe and North America, with nearly 65% of all transactions in Q1, as conditions are ripe for industry consolidation and deployment of capital for solar development.

.jpg)

An Analysis of Global Solar Energy Trends

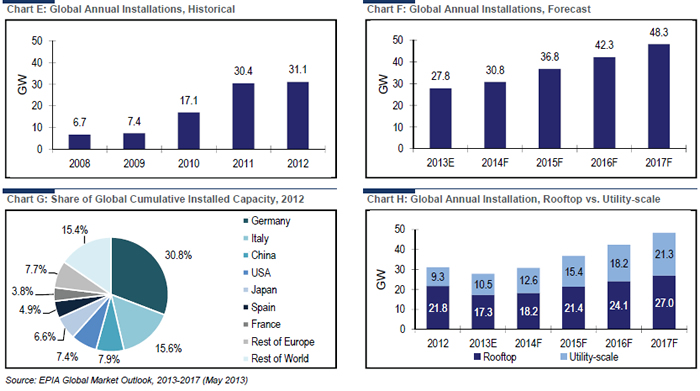

Solar market growth slowed in 2012, after setting a record pace in 2011. While the market stabilized solar is still becoming a larger source of power generation, expected to surpass 100 GW of cumulative installed capacity globally this year. In 2013, the expected growth of markets outside of Europe is unlikely to fully compensate for the slowdown in the mature European market. Moving forward, growth in demand is expected to be driven by price decreases for solar systems and the development of untapped markets as the industry is no longer relying on some of the historically strong geographies. This trend is demonstrated in Chart F, where after a slight decline in 2013, the solar industry is expected to return to moderate expansion from 2014 to 2017. Europe has traditionally dominated the solar market, but the rest of the world has been catching up at a rapid pace. In fact, Europe’s share of the market shrunk from 74% in 2011 to 55% in 2012. It is expected that the market will continue to diversify in 2013, with Europe’s share falling below 50%. Outside of Europe, the market is wellbalanced. China, the United States and Japan are leaders with great potential for future growth. In 2012, China became the third largest solar market globally ahead of the U.S. and Japan, as illustrated in Chart G. These three geographies are followed by a secondary market of relatively untapped developing countries who could shape the face of PV in the future. Currently, the split between rooftop and utility-scale solar installations is weighted toward the rooftop segment, as shown in Chart H. However, this segmentation is expected to shift in the future as utilityscale plants are forecasted to see much faster growth globally. However, in certain markets, such as the U.S., rooftop projects are expected to experience faster growth with the expansion of solar leasing programs. Overall the prospects for solar are expected to be positive globally as the market matures.

Lincoln International

Lincoln International specializes in merger and acquisition advisory services, debt advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With fourteen offices in the Americas, Asia and Europe, Lincoln International has strong local knowledge and contacts in key global economies. The firm provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product