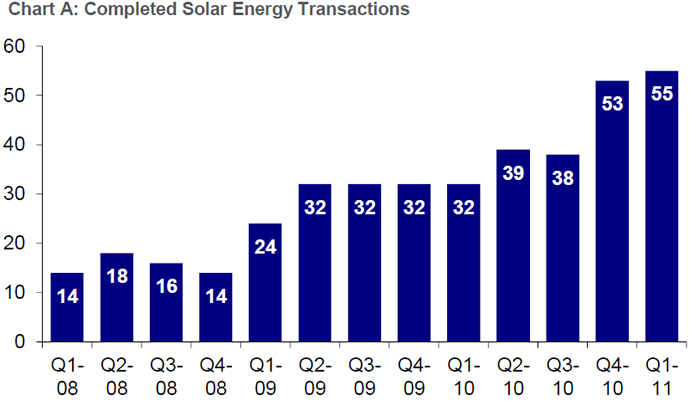

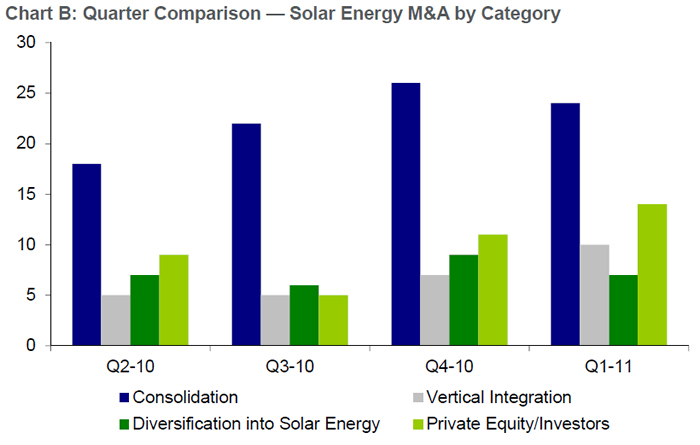

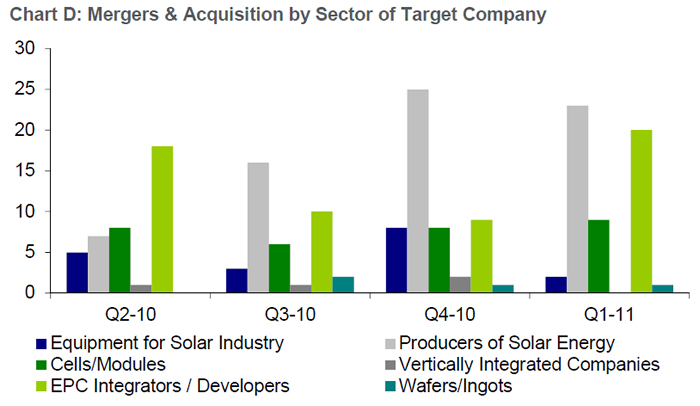

2011 is off to the fastest start from a transaction perspective since this activity has been tracked. The consolidations of solar project portfolios and sales of solar projects continue to dominate the transaction landscape. However, the increased availability of credit has generated a significant increase in private investment both through the acquisition of projects as well as companies within the supply chain.

Q1 2011 Solar Deal Volume Comparison

Contributed by Jack Calderon and Chaim Lubin | Lincoln International

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product