Introduction to Solar Outdoor LED Light

Solar lights are referred to as the light fixtures powered by solar panels, and are usually integrated in the pole or mounted at the top of lighting source. These lights comprises of a solar panel (photo-voltaic panel), rechargeable battery and a LED lamp integrated as a single unit. One of the most prevalent application of these light sources are street lights. However, these lights are also used for both indoor and outdoor application.

Market Overview and Growth Highlights 2018-2027

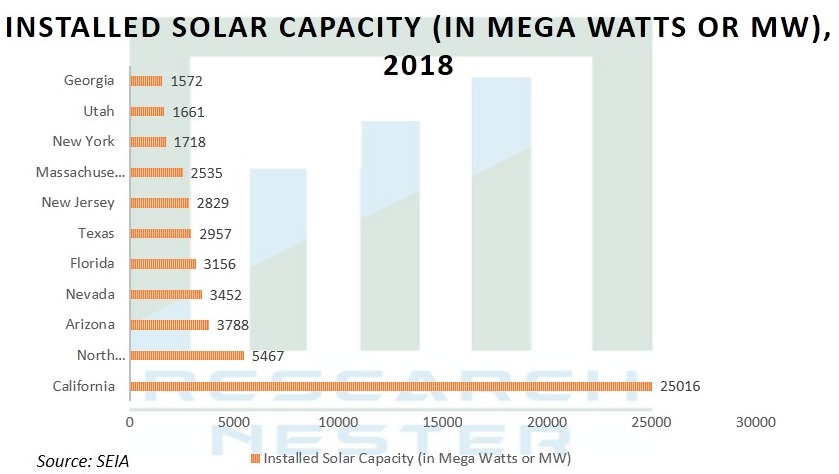

The increasing application of solar energy in the United States owing to growing concerns for the environment is believed to benefit the expansion of the U.S. solar outdoor LED light market. Additionally, increasing solar capacity and the rise in deployment of solar panels in the region, is also promoting the growth of the market. According to Solar Energy Industries Association (SEIA), the country installed a solar energy capacity of 10.6 GW in the year 2017. Additionally, California dominated the U.S. solar market in 2018 with a total installed capacity of 25, 016 MW.

These factors are driving the manufacturers to develop and meet the demand for efficient solar outdoor LED lights. Further, the U.S. solar outdoor LED light market is slated to grow at a highest CAGR of 12.6% over the forecast period, i.e. 2019-2027. This demand is primarily due to the increasing demand from consumers for energy-efficient lighting systems, rising penetration of LED as a light source and projections for the reduction in prices of solar LEDs and photovoltaic (PV) cells. Furthermore, rapid rise in the solar new capacity electric generation market share out of total electrical generation in the U.S., which grew from around 0.1% in 2010 to more than 2% in 2019, according to the report by SEIA, is also expected to contribute significantly towards driving the growth of the U.S. solar outdoor LED light market in the forthcoming years. Further, the U.S. solar outdoor LED light market is estimated to be around USD 781.1 Million in the year 2018 and is further forecasted to reach USD 2263.10 Million in the year 2027. CLICK TO DOWNLOAD SAMPLE REPORT

Market Segmentation Synopsis

By Product

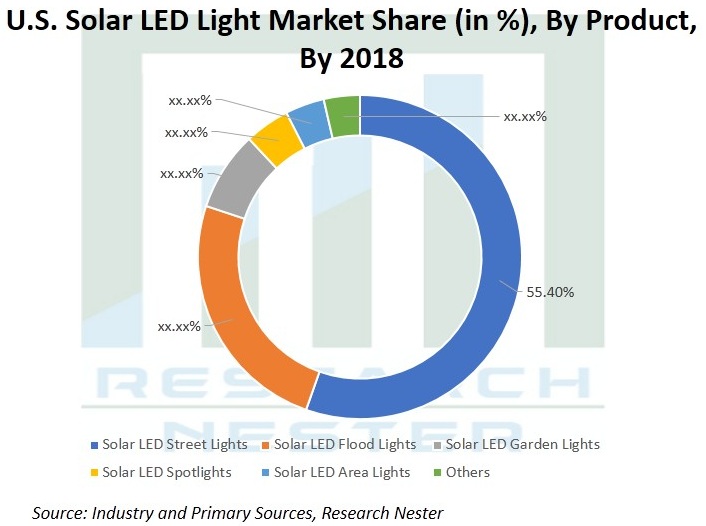

The U.S. solar outdoor LED light market is segmented on the basis of product into solar LED street lights, flood lights, garden lights, spot lights, area lights and others. Solar LED street lights segment was estimated with a market share of 55.4% in the year 2018, and is showcasing great potential for the future growth of the segment. Factors such as growing initiatives in building smart cities with the incorporation of advanced technologies and energy efficient lighting solutions in both residential and commercial sectors, coupled with the rise in urbanization and the growing public awareness for cost efficient lighting solutions, all of these factors are anticipated to propel the growth of the market positively during the forecast period. Additionally, the solar LED flood lights segment is forecasted to achieve a valuation of USD 561.25 Million by 2027.

By Installation Type

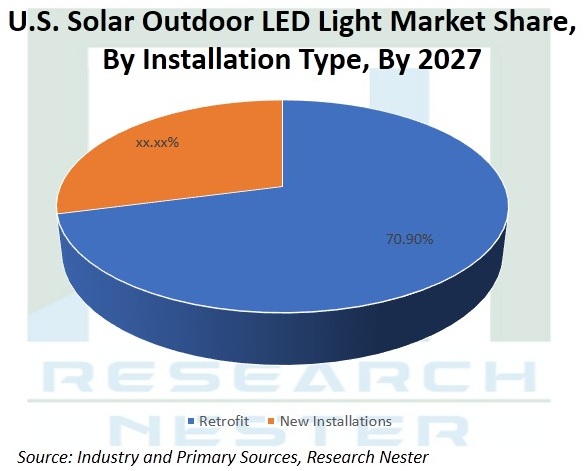

The U.S. solar outdoor LED light market is segmented on the basis of installation type into retrofit and new installations. It is observed that there is a high demand for retrofit as compared to new installations owing to rising replacements of incandescent lights in the existing outdoor infrastructure, with the energy efficient light sources. The retrofit segment is anticipated to reach a market share of 70.9% by 2027.

By End User

The U.S. solar outdoor LED light market is also divided on the basis of end user into residential, institutional, industrial and commercial. The commercial segment held the largest market share of around 34.0% during 2018 and is expected to garner significant market size by the end of 2027. Further, the industrial segment is anticipated to reach a valuation of USD 744.6 Million by 2027.

Market Driver & Challenges

Growth Indicators

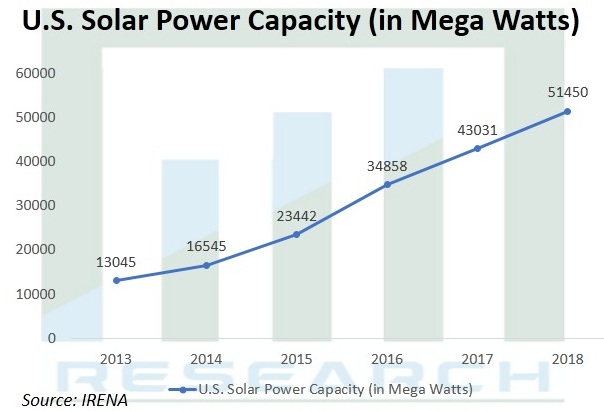

The U.S. solar outdoor LED light market is thriving on the back of increasing solar power capacity in the country, coupled with, increase in awareness for environmental related concerns and rise in purchasing power of the individuals. According to International Renewable Energy Agency (IRENA), solar power capacity in the U.S. grew from 13, 045 Mega Watts in the year 2013 to 51, 450 Mega Watts in the year 2018, with a growth rate of 3.94x.

Additionally, factors such as growing installation and adaption of solar energy panels, coupled with, the reduction in cost of solar products owing to subsidies provided by the government to encourage the sales of solar products, is also anticipated to promote the growth of the U.S. solar outdoor LED light market during the forecast period.

Barriers

The cost constraints involved in the installation of solar lighting setup, coupled with high cost of maintenance, high initial investment, and other environmental factors, such as unavailability of sufficient solar heat on cloudy and rainy days, during night hours, and other climatic conditions, all of these factors are estimated to have a negative impact on the growth of the U.S. solar outdoor LED light market.

Competitive Landscape

Some of the affluent industry leaders in the U.S. solar outdoor LED light market are Signify Holding, Hubbell, Carmanah, Leadsun, Solar Lighting International, Inc., Solar Electric Power Company (SEPCO) and OSRAM Licht AG.

Companies are making various efforts to expand their product portfolio to strengthen their position in the market. Moreover, market players are continuously focusing towards the advancement and diversification of their products. Manufacturers are increasingly offering solar outdoor LED lights with enhanced efficiency. The expansion of product portfolio is further helping the companies to maintain their growth and gain competitive edge in the U.S. solar outdoor LED light market.