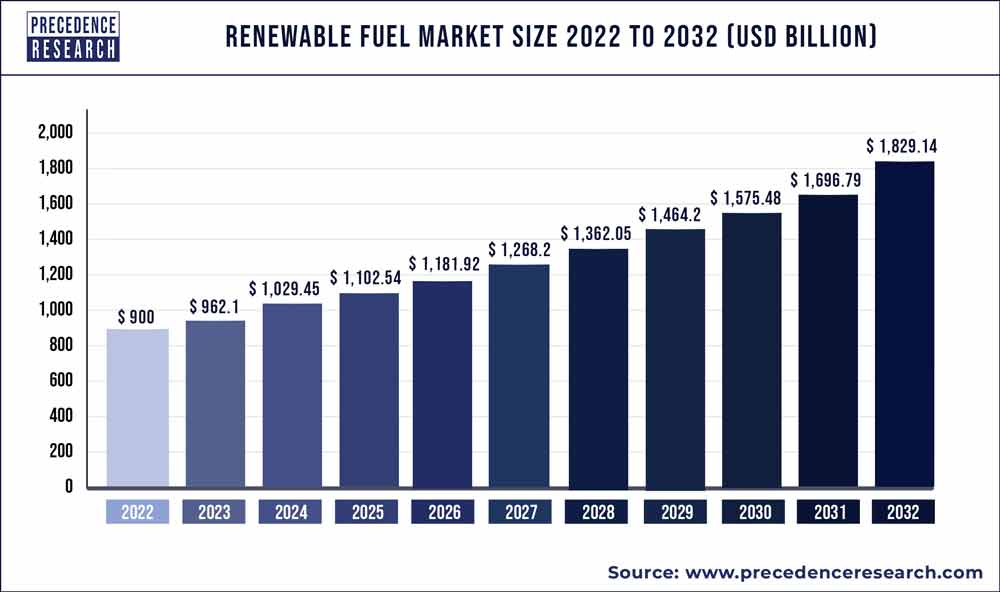

The global renewable fuel market size was valued at US$ 900 billion in 2022 and it is expected to surpass around US$ 1,829.14 billion by 2032 with a registered CAGR of 7.4% during the forecast period 2023 to 2032.

To Access our Exclusive Data Intelligence Tool with 15000+ Database, Visit: Precedence Statistics

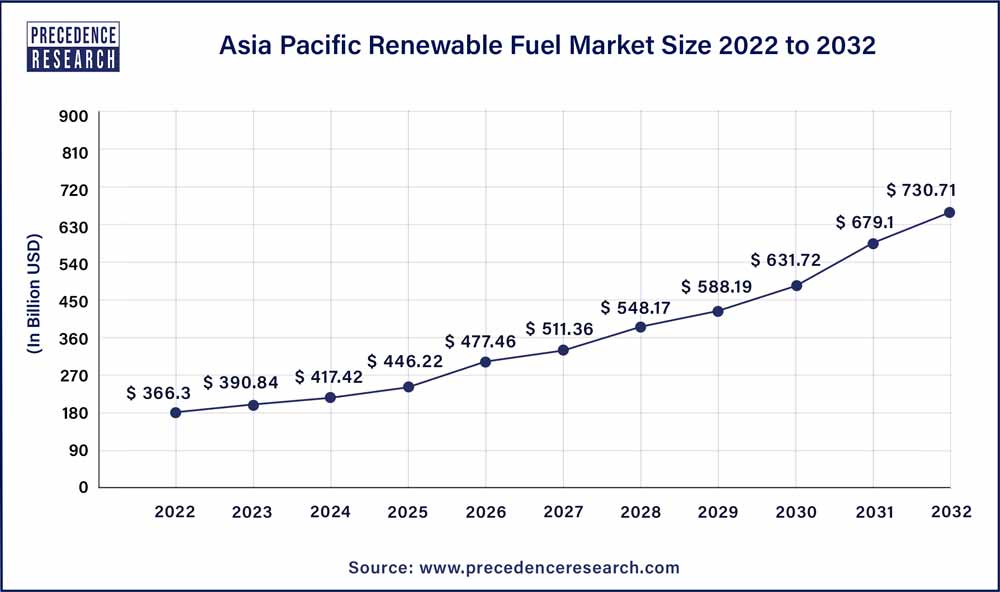

Asia-Pacific dominated the renewable fuel market in 2022. China and India dominated the renewable fuel market in Asia-Pacific region. China will be the world leader in renewable fuel by 2032. In 2020, the country’s total renewable energy capacity was 894 GW, the surge of 17.9% over the last year. The nation’s main renewable fuel sources include solar, hydropower, and wind. In addition, the growing government initiatives is driving the growth of renewable fuel market in Asia-Pacific region. By 2022, the Indian government wants to install 175 GW of renewable fuel capacity, with 100 GW of solar, 10 GW of biopower, 60 GW of wind, and 5 GW of small hydropower. In addition, by 2022, the Indian Ministry of New and Renewable Energy aims to fund $15 billion in renewable fuel.

North America is expected to develop at the fastest rate during the forecast period. The U.S. dominates the renewable fuel market in North America region. The renewable fuel market in North America region is growing due to the surge in demand for biofuel in the region. Biofuels, such as biodiesel and biogasoline, produced 623 thousand barrels of oil equivalent per day in the North American region in 2020. Ethanol contributed substantially more to output than biodiesel, contributing for over 500 thousand barrels of oil equivalent per day.

One of the key factors driving the growth of global renewable fuel market is technological advancements and adoption of innovative technologies. The surge in demand for electricity is also boosting the expansion of global renewable fuel market. In addition, growing government initiatives for the development of power industry is also contributing towards the growth of global renewable fuel market. The government is providing subsidies and incentives to the market players operating in global renewable fuel market.

Biofuels are being regarded as one of the future cleaner fuel alternatives to traditional fossil fuels. Additionally, the availability of funds and finance resources for research and development to develop biofuels at a reduced cost will increase their use. Moreover, continuous research into the commercialization of second and third generation biofuels will support the growth of global renewable fuel market throughout the projection period.

The key market players are focusing even more on long term values, and several of the region’s biggest market players have established sustainable sourcing techniques for evaluating long term contracts. To acquire market share, the leading players in the global renewable fuel market are likewise adopting a stable and low risk strategy. To meet the increased demand, firms have been expanding their operations through various acquisitions and mergers. In addition, government all around the world is collaborating with market players.

| Report Coverage | Details |

| Market Size in 2023 | USD 962.1 Billion |

| Market Size by 2032 | USD 1,829.14 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.4% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, End User, Application, Geography |

| Companies Mentioned | Ocean Power Technologies, NextEra Energy, Inc., Enel Group, ONPOWER Business Energy, Yingli Solar, Tocardo BV, SynTech Bioenergy, Siemens AG, Canadian Solar Inc., Invenergy LLC, Geronimo Energy Holdings LLC, Xcel Energy, TATA Power, ABB Product Group Solar |

The biofuel segment dominated the renewable fuel market in 2022. Biofuels are fuels made from animal, plants, and waste. They are classified as renewable fuels because the feed substance used can be regenerated more quickly than traditional fossil fuels. Some of the elements that are projected to boost the market include the limited supply of fossil fuel-based resources and increased awareness of the need to reduce carbon emissions. Furthermore, the availability of various supporting regulatory regulations and financial incentives on the use of biofuels around the world is expected to boost their demand, particularly in the transportation industry.

The wind power segment is fastest growing segment over the forecast period. The wind turbine turns wind energy into mechanical energy, which is then transformed into electrical energy by the generator. The offshore and onshore wind energy can be generated. The onshore wind power is linked with land-based turbines, while offshore wind turbines are located in the ocean. The offshore wind turbines, on the other hand, are well-organized than onshore wind turbines due to the stable wind flow.

The industrial segment dominated the renewable fuel market in 2022. The rising demand for clean energy is predicted to boost the number of utility projects and boost the market for renewable fuel in the industrial sector. The growing industrial projects are also driving the growth of the industrial segment.

The commercial segment is expected to witness significant growth over the forecast period. The growing power demand in communication base stations and data centers, combined with increasing acceptance of renewable fuel in hotels, corporate offices, and hospitals, is likely to stimulate product demand across the commercial sector.

(Note*: We offer report based on sub segments as well. Kindly, let us know if you are interested)

By Type

By End Use

By Application

By Geography

PROCEED TO BUY :

ASK FOR SAMPLE

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client