In this paper, we discuss the critical issues that sources and states face in evaluating EPA's proposal and developing plans to meet the Clean Power Plan requirements.

Chris MacCracken, Steven Fine, Phil Mihlmester, David Pickles and Ankit Saraf | ICF INTERNATIONAL

Executive Summary

Quick Background and Timeline

First Order of Business: Understanding the Building Blocks to BSER

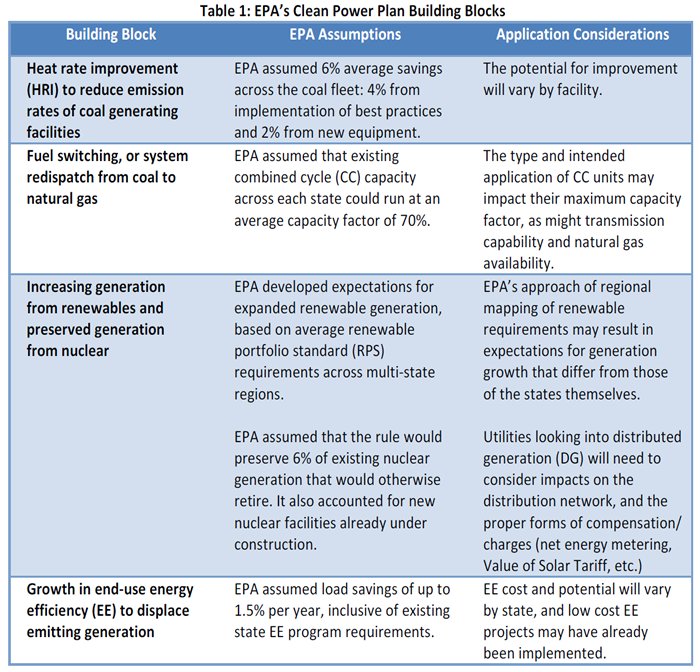

Source: EPA Goal Computation Technical Support Document (Data File: Goal Computation - Appendix 1 and 2)

Beyond Comments: Assessing the Foundations of a Plan

Flexibility in Technology

Flexibility in Policy Mechanisms

States and affected entities may reduce compliance costs by understanding the pros and cons of each type of rule and the point(s) of regulation with respect to measuring and achieving compliance.

Flexibility in Geographic Scope

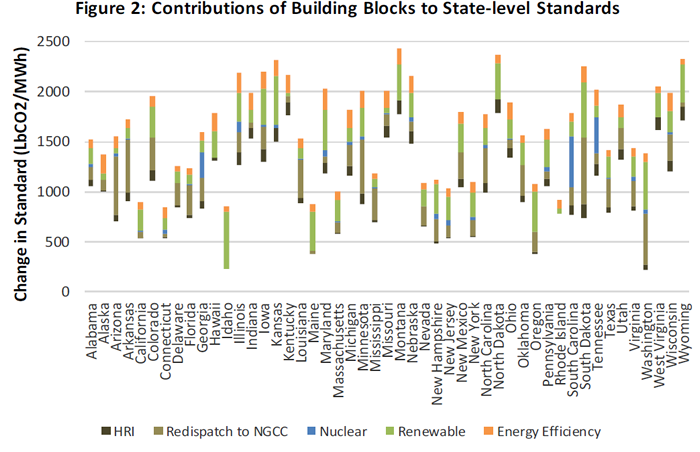

Assessing the relative costs of compliance in potential partner states will help affected sources determine whether they will be buyers or sellers in a multi-state program, and how allowance trading or multi-state averaging will impact compliance costs and electricity prices.

Industry Challenges: Implications

Power Prices Move Depending on the Approach that States Adopt

- The achievement of the standard through a tradable emission rate limit, similar to NRDC’s proposed approach and the way in which EPA modeled the program in its analysis, could result in credits to generation sources that emit below their state standard. Those credits may generate revenue, potentially lowering wholesale power prices through the transfer of payments from high emitting sources such as coal generation, to low emitting sources such as gas generation, so long as such gas generators continue to be the marginal units that set power prices.

- Under a portfolio approach that requires an amount of renewable generation through an RPS, an amount of energy efficiency through an efficiency standard, and generator emission reductions at the source, wholesale electricity prices could be little affected. Instead, the costs of the program would be primarily felt through retail rates.

- A plan with a mass-based cap with trading would add a positive dispatch cost to all emitting units, and all else equal, result in higher wholesale and retail power prices.

- Generators in states that opt to join multi-state groups may benefit from lower cost compliance options in the partner states, or from generating emission reduction credits for sale in those states.

Multi-state Management Requires Attention

Infrastructure Needs Shift

- In its analysis, EPA projected coal unit retirements to double by 2030 relative to a business-as-usual case. While the actual result may differ, generators and system operators must examine the retirements that might result and how they could impact system reliability, as well as capacity market dynamics in relevant areas.

- Generators will also need to know whether they have access to adequate gas pipeline infrastructure, and the delivered cost of the fuel, should they need to rely on gas-fired generation to a greater degree than in past years.

- Similarly, companies seeking to deploy more wind will need to examine whether or not there is adequate transmission capacity to support development. States seeking to deploy more distributed generation (DG)—such as solar PV, and CHP—will need to understand the impacts of high DG penetration on the distribution grid, and how energy storage fits into this plan.

Energy Demand Responds

Industry Challenges: Implementation

Putting it all Together

About the Authors

About ICF International

Since 1969, ICF International (NASDAQ:ICFI) has been serving government at all levels, major corporations, and multilateral institutions. With more than 60 offices and more than 4,500 employees worldwide, we bring deep domain expertise, problem- solving capabilities, and a results-driven approach to deliver strategic value across the lifecycle of client programs.

Since 1969, ICF International (NASDAQ:ICFI) has been serving government at all levels, major corporations, and multilateral institutions. With more than 60 offices and more than 4,500 employees worldwide, we bring deep domain expertise, problem- solving capabilities, and a results-driven approach to deliver strategic value across the lifecycle of client programs.The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (5)

Featured Product