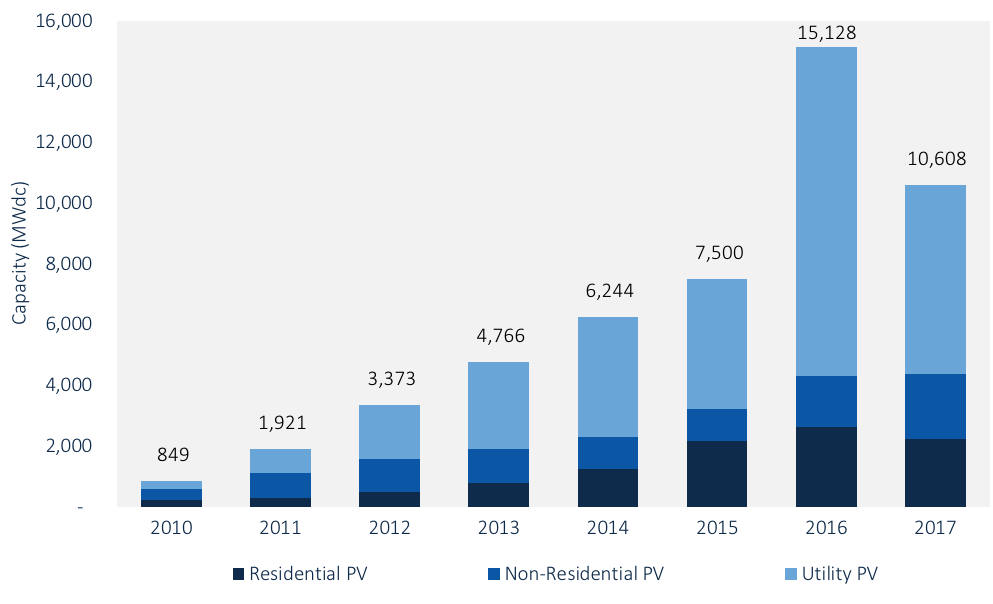

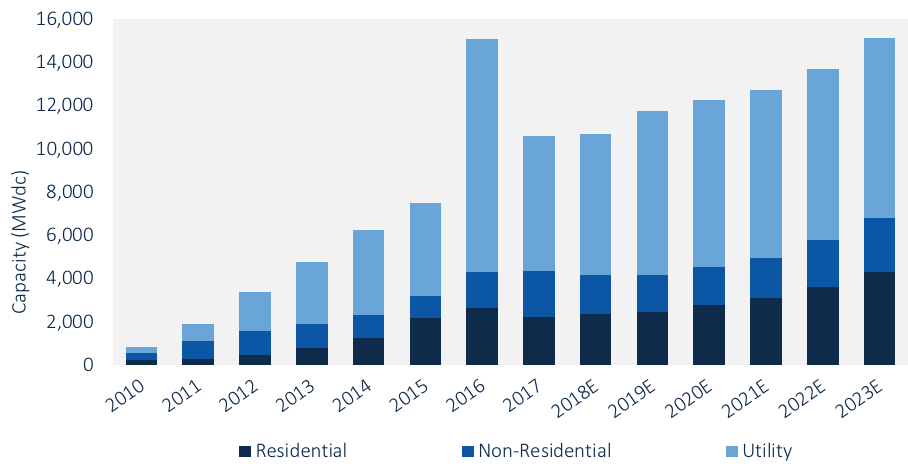

U.S. Solar Market Adds 10.6 GW of PV in 2017, Community Solar Soars

|

BOSTON, Mass. and WASHINGTON D.C. – In 2017, the U.S. solar market expanded, adding double-digit gigawatt solar photovoltaic (PV) additions for the second year in a row. According to the newly released U.S. Solar Market Insight Report 2017 Year-in-Review from GTM Research and the Solar Energy Industries Association (SEIA), the solar industry installed 10.6 gigawatts (GW) of new PV capacity in 2017, led by strong growth in the corporate and community solar segments.

|

|

About U.S. Solar Market Insight: The U.S. Solar Market Insight report is the most detailed and timely research available on the continuing growth and opportunity in the U.S. The report includes deep analysis of solar markets, technologies and pricing, identifying the key metrics that will help solar decision-makers navigate the market's current and forecasted trajectory. For more information, visit www.greentechmedia.com/research/ussmi About GTM Research: |

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product