GAS, SOLAR TO LEAD AS AMERICAS INVEST $1.3 TRILLION TO BUILD 2030 POWER CAPACITY

Coal-fired generation to shrink as technology costs move decisively in favor of gas-fired and renewable technologies

London and New York, 1 July – The next decade and a half will see renewable energy raise its share of electricity generation capacity in the Americas from 7% in 2012, to 28% in 2030 (excluding the contribution of hydroelectric power), while the share of coal-fired capacity falls from 21% to 9%, according to a major report from research company Bloomberg New Energy Finance.

The report, BNEF's 2030 Market Outlook, forecasts that North, Central and South America will add 943GW of gross new capacity by 2030, including replacement plants. Some 522GW will be added in the US, 341GW in Latin America and 80GW in Canada.

This will equate to $1.3 trillion of investment in new power generation capacity [1], with the largest single slice of that going to gas-fired plants, at $314bn ‒ benefitting from the persistence of low natural gas prices in North America following the shale gas boom. The figures are based on modelling of electricity market supply and demand, technology costs and policy development by country and region.

The other technologies attracting significant investment will be rooftop photovoltaics, at $231bn, and onshore wind, at $200bn. There will be smaller slices of investment going to nuclear (almost all in the US), hydroelectric (mainly in Latin America), biomass-to-power, offshore wind and large-scale solar.

Michel DiCapua, head of Americas analysis for Bloomberg New Energy Finance, said: "Two striking conclusions from our research: first, wind and solar will win bigger and bigger shares of the investment in new capacity as their technology costs go on falling; second, coal will be in rapid retreat, its share of generation in the Americas falling from 26% in 2012 to 17% in 2030 [2].

The research company's model suggests that energy efficiency gains will mean that US electricity demand rises at just 0.5% per year over 2014-30, much more slowly than GDP. In contrast, electricity demand will increase at 3% a year in Latin America on the back of rapid economic development.

The US will continue to enjoy natural gas prices of less than $5 per MMBtu until 2024, before they start to rise sharply in response to the depletion of some of the main gas plays and to increased demand from power, industry and exports, according to the report. Between 2013 and 2030, the US fleet of gas-fired power stations will increase by a net 134GW.

Coal-fired capacity will meanwhile shrink by 109GW, mainly due to being out-competed by gas and renewables but also partly because of regulatory curbs such as the standards announced in June by the Environmental Protection Agency. Nuclear is expected to see 10GW of net new-build by 2030, after allowing for decommissioning of some older plants, while renewable power capacity increases by 275GW, the largest contributors to that being small-scale solar and onshore wind.

Latin America is predicted to add some 102GW of new solar capacity between 2013 and 2030, most of it small-scale rooftop photovoltaics but also some utility-scale solar farms, particularly in arid regions. It will also add some 71GW of wind power and 103GW of other renewables such as hydro-electric and biomass-to-power. Fossil-fuel generation will see only around 48GW of net new capacity added in the region, as the cost comparison increasingly favors renewables.

GLOBAL NUMBERS

Globally, Bloomberg New Energy Finance expects $7.7 trillion to be invested in new generating capacity by 2030, with 66% of that going on renewable technologies including hydro. Out of the $5.1 trillion to be spent on renewables, Asia-Pacific will account for $2.5 trillion, the Americas $816bn, Europe $967bn and the rest of the world including Middle East and Africa $818bn.

Fossil fuels will retain the biggest share of power generation by 2030, at 44%, albeit down from 64% in 2013. Some 1,073GW of new coal, gas and oil capacity worldwide will be added over the next 16 years, excluding replacement plants. The vast majority will be in developing countries seeking to meet the increased power demand that comes with industrialization, and also to balance variable generation sources such as wind and solar. Solar PV and wind will increase their combined share of global generation from 3% last year to 16% in 2030.

Michael Liebreich, chairman of the advisory board for Bloomberg New Energy Finance, commented: "This country-by-country, technology-by-technology forecast of power market investment is more bullish on renewable energy's future share of total generation than some of the other major forecasts, largely because we have a more bullish view of continuing cost reductions. What we are seeing is global CO2 emissions on track to stop growing by the end of next decade, with the peak only pushed back because of fast-growing developing countries, which continue adding fossil fuel capacity as well as renewables."

Featured Product

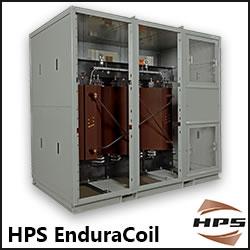

HPS EnduraCoilTM Cast Resin Medium Voltage Transformer

HPS EnduraCoil is a high-performance cast resin transformer designed for many demanding and diverse applications while minimizing both installation and maintenance costs. Coils are formed with mineral-filled epoxy, reinforced with fiberglass and cast to provide complete void-free resin impregnation throughout the entire insulation system. HPS EnduraCoil complies with the new NRCan 2019 and DOE 2016 efficiency regulations and is approved by both UL and CSA standards. It is also seismic qualified per IBC 2012/ASCE 7-10/CBC 2013. Cast resin transformers are self-extinguishing in the unlikely event of fire, environmentally friendly and offer greater resistance to short circuits. HPS also offers wide range of accessories for transformer protection and monitoring requirements.