Bitcoin Mining and Energy Production

Bitcoin sustainably converts otherwise discarded energy into a form of money available to all people, stimulating local economies and creating jobs.

Bitcoin, and the mining industry behind it, have been strongly criticized for “immense” energy consumption. To put things into perspective, the Bitcoin network is estimated to consume 108 terawatts of energy annually. Bitcoin is considered “digital gold” by many, so the best comparison is the gold mining industry, which utilizes 130 Terawatts. Considering Bitcoin as money, instead, would make the global banking system, which conservatively uses 100 Terawatts the next best comparison. The estimate is highly conservative since it does not consider the energy used to enforce the fiat standard. Clearly, Bitcoin’s energy consumption is not out of line with its most relevant competitors.

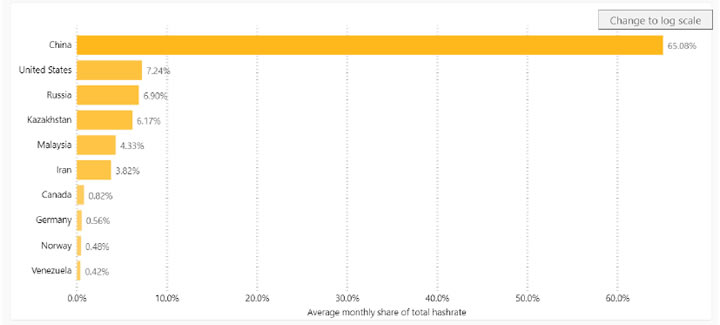

While the US dominates the global banking system through the use of the dollar, it has lagged behind in the Bitcoin mining industry and is thus falling behind in the quickly rising encryption economy. Currently, China houses 65% of the Bitcoin mining network which is largely powered by renewable energy, reducing the negative impact of the amount of energy they use. The United States, on the other hand, is responsible for a mere 7% of the network with Russia and Kazakhstan following closely behind. There i s a tremendous opportunity for American innovation in this space.

Bitcoin Mining Hashrate Per Country in 2020

The primary reason the United States is lagging behind is the l ack of agreements and partnerships between power companies and Bitcoin miners. Some Asian companies have vertically integrated their power generation or built special deals with governments. This push has enabled them to dominate the market, but only because the US hasn’t taken it seriously yet. Conversion of energy into value is something analogous to the energy needed to mine gold, oil or other natural resources. Like these other mining endeavors, there are fixed costs and variable costs in mining new Bitcoin. Once mined, Bitcoin can be immediately converted into dollars or held for its appreciating store of value attributes. Bitcoin mining has high energy demands and can take advantage of underutilized energy resources since the lower the energy cost, the higher the profit. Energy producers choose to either sell otherwise wasted energy to miners or to bolster their bottom line and business by becoming a bitcoin miner directly.

Contact Sazmining today to learn more about how we can help you take part in the digital revolution.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product

Terrasmart - Reduce Risk and Accelerate Solar Installations

We push the limits in renewable energy, focusing on innovation to drive progress. Pioneering new solutions and ground-breaking technology, and smarter ways of working to make progress for our clients and the industry.