Despite its promise, the second-life battery market in the United States remains underdeveloped, hindered by significant challenges. This article explores the issues limiting the growth of this market and what it will take to unlock its potential.

The Truth Behind Second-Life Batteries: Why Reuse Is Lagging Behind

Article from | Bluewater Battery Logistics

The global push for renewable energy and electrification is driving an unprecedented production of lithium-ion batteries. Approximately ten to fifteen percent of new batteries remain unused in their intended first-life applications due to various factors – including overproduction and cancelled projects. While recycling is critical for end-of-life batteries, the concept of second-life reuse, where unused and surplus batteries are repurposed for other applications, offers tremendous environmental and economic benefits.

Yet, despite its promise, the second-life battery market in the United States remains underdeveloped, hindered by significant challenges. This article explores the issues limiting the growth of this market and what it will take to unlock its potential.

The Untapped Potential of Second-Life Batteries

The elephant in the room is that a large proportion of lithium-ion batteries retired today (many of them are new, never cycled, or used with a state of health (SOH) exceeding 80%) are sent directly to recycling facilities instead of being sold for a second-life application. This includes new surplus batteries, manufacturing fallout (unused but functional cells and modules), and lightly used batteries. Despite being cheaper than new batteries, these batteries are largely overlooked for reuse in favor of recycling.

There are a few reasons for this inefficiency. Surplus and retired batteries are less desirable due to lack of warranty, logistical challenges, testing requirements, and the perception that new batteries, which are decreasing in cost, are a better investment. Yet, giving these batteries a second life would not only reduce waste but also lower the carbon footprint associated with manufacturing new batteries.

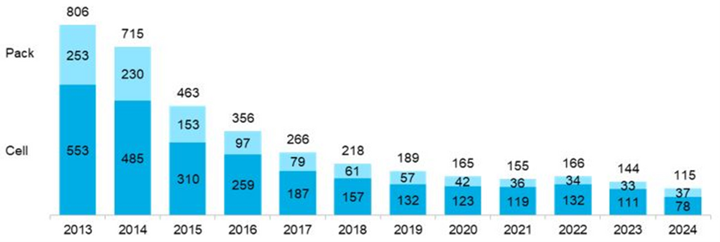

Economic Pressures: The Price Challenge

The present decline in new lithium-ion battery prices has created a significant obstacle for the second-life market. In 2024, prices for new cells in China fell as low as $30–50 per kWh. Several issues have caused this:

- Oversupply. The rapid expansion of battery manufacturing capacity has outpaced demand, leading to intense price competition.

- Technological Advancements. The emergence of cheaper battery chemistries, such as lithium iron phosphate (LFP) and sodium-ion, has further driven down costs.

- Market Dynamics. Innovation and scaling in the battery market have created an environment where new batteries are often priced competitively with second-life alternatives.

Low prices for new battery cells have made it challenging for companies using second-life batteries in their products to offer a sufficient discount to attract buyers. Many buyers prefer to purchase new batteries with warranties and the latest technology, leaving second-life batteries struggling to compete.

Logistical and Operational Barriers

The logistics and operations involved in repurposing lithium-ion batteries are another significant hurdle. These issues include:

- Testing and Certification. Batteries require rigorous testing to ensure safety and performance. This process is costly and time-consuming, especially when dealing with large quantities.

- Regulatory Compliance. Shipping and handling batteries involve intricate regulatory requirements, including classification, packaging, labeling, and documentation. Missteps delay shipments and increase costs.

- Lack of Standardization. The absence of standardized processes for testing and grading batteries adds complexity to transactions and discourages buyers and sellers.

Owners of retired batteries and cells also face significant costs and risks when disposing of or selling batteries for second-life use. Contracts can take months to finalize, and shipping costs (both domestic and international) are substantial. For example, cross-country truck shipments can cost $5,000–6,000, international shipments often require expensive UN-certified packaging.

Why the USA Lags Behind Other Markets

The second-life battery market in the United States trails behind its counterparts in Asia and Europe, where the industry is more mature. Asian and European companies have developed the infrastructure, financing, and expertise needed to handle large volumes of retired batteries across various chemistries and form factors. In contrast, the U.S. market remains fragmented and immature. A significant challenge in the U.S. is the disconnect between first-life battery owners and second-life buyers. First-life owners often expect to recoup 50% or more of the original value of their batteries. However, second-life companies typically aim to pay only 10–20% of the original price to remain viable. This disparity, coupled with the rapid obsolescence of older battery technologies, creates a mismatch of expectations.

Additionally, the lack of standards and testing capabilities among first-life owners slows down transactions. Comprehensive testing is often required by second-life buyers, but many first-life owners lack the equipment or resources to test batteries on a scale.

The Path Forward

Despite these challenges, the large-scale second-life battery market has immense potential to deliver environmental and economic benefits. Reusing batteries extends their lifecycle, reduces waste and the environmental impact of lithium-ion battery production. Second-life batteries provide affordable solutions for battery energy storage and e-mobility, accelerating electrification efforts globally.

To realize this potential, several steps must be taken.

- Standardization of testing and grading processes will reduce inefficiencies and reduce the prices of second-life battery by removing labor costs.

- Designing batteries for second use can help a lot. Starting from easier disassembly to accessible and reliable structured data on each battery and cell in a digital battery passport (mandatory in EU as of 2025).

- Raising awareness among first-life owners about the benefits of second-life reuse (both environmental and financial) as well as demystifying legal risks can help shift market behavior.

Conclusion

The second-life battery market represents a critical opportunity to reduce waste, lower costs, and support a more sustainable future. However, overcoming the barriers to market growth, ranging from pricing challenges to legal and logistical inefficiencies will require collective action from stakeholders across the industry.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product