Solar PV Equipment Spending Declines 72% to $3.6 Billion in 2012, According to NPD Solarbuzz

Forecast for 2013 is Further Decline to $2.2 Billion; Survival Strategies Essential to Address Prolonged Downturn in PV Investment

Santa Clara, Calif. January 17, 2013

Solar photovoltaic (PV) equipment spending (covering c-Si ingot-to-module and thin-film) was $3.6 billion for 2012, a 72% decline from the peak of $12.9 billion in 2011, according to new research in the latest NPD Solarbuzz PV Equipment Quarterly report.

According to Finlay Colville, Vice President at NPD Solarbuzz, "Spending for 2013 is forecast to decline even further to $2.2 billion, levels not seen in the industry since 2006. This marks an effective halt to capacity investment by PV manufacturers, as well as a lack of upgrades, whether in new technology or higher efficiency. Spending on high-efficiency process steps barely contributed to 2012 shipments, representing less than 5% of PV equipment spending."

Based on PV revenues recognized in the calendar year 2012, the leading equipment suppliers are forecast to be GT Advanced Technologies, Meyer Burger, Applied Materials, and Apollo Solar. These tool suppliers are expected to have PV-specific revenues in excess of $400 million. Only eight PV equipment suppliers are forecast to have PV-specific revenues during 2012 in excess of $100 million, compared to 23 in 2011.

Just 24 months ago, GT Advanced Technologies, Meyer Burger, Applied Materials, and Centrotherm each reported PV backlogs at or above $1 billion. However, successive quarters with minimal new order intake, coupled with strong de-bookings, have reduced PV equipment backlogs to levels last experienced in 1H'06.

"PV equipment suppliers now find themselves a victim of their own success," added Colville. "Excessive investment in 2010 and 2011 was the catalyst of the over-capacity and over-supply situation that exists today. It was also a key factor in end-market price erosion that forced many of their customers to file for insolvency. The days of PV-specific backlogs and revenues at the billion-dollar level are unlikely to be repeated for at least three years."

With so much competitive c-Si capacity shipped during 2011 and 2012, the biggest fear for tool suppliers is the emergence of a secondary equipment market across China and Taiwan. Most importantly, this would delay any upturn in equipment spending. However, it also suggests that the PV industry is not conforming to a collective roadmap or experiencing a significant technology-buy cycle.

"Today, there are actually two factors that may result in legacy capacity being recycled," noted Colville. "First, the forced consolidation of tier 1 and tier 2 c-Si manufacturers in China would prevent any strong shakeout of excess capacity within China. Also, trade wars may result in surplus capacity simply being relocated outside China to avoid import tariffs, with overseas countries welcoming any resulting job creation."

During 2012, performing a market-share analysis for key tool suppliers to the PV industry was of limited value. This was because a large part of revenues was based on tools shipped at the end of 2011 or new shipments required by legacy contracts. Indeed, the focus of equipment suppliers has now shifted from gaining market share within the PV industry to deciding how to restructure manufacturing and streamline PV R&D.

"Tool suppliers are finally acknowledging that high-efficiency upgrades are not going to offer any short-term salvation during 2013," concluded Colville. "However, it remains imperative to equipment suppliers that efforts remain targeted at enhancing efficiency and understanding which technology roadmap will help them gain market share when spending finally returns."

For more information or to order the NPD Solarbuzz PV Equipment Quarterly, contact us at one of our seven global locations, email us at contact(at)solarbuzz(dot)com, or call Charles Camaroto at 1.516.625.2452 for more information.

About NPD Solarbuzz

NPD Solarbuzz is a globally recognized market research business focused on solar energy and photovoltaic industries. Since 2001, NPD Solarbuzz has grown its client base to include many of the largest global PV manufacturers, major investment banks, equipment manufacturers, materials suppliers, hedge fund companies, and a vast range of other multi-nationals. NPD Solarbuzz offers a wide array of reports, including Marketbuzz, an annual global PV industry report, and Solarbuzz Quarterly, which details both historical and forecast data on the global PV supply chain. The company's research also provides annual downstream PV market reports by region for Europe, Asia Pacific and US markets. In addition, Solarbuzz.com is a recognized and respected online resource within the solar industry. For more information, visit http://www.solarbuzz.com or follow us on Twitter at @Solarbuzz.

About The NPD Group, Inc.

The NPD Group provides global information and advisory services to drive better business decisions. By combining unique data assets with unmatched industry expertise, we help our clients track their markets, understand consumers, and drive profitable growth. Sectors covered include automotive, beauty, entertainment, fashion, food/foodservice, home, office supplies, sports, technology, toys, video games, and wireless. For more information, visit npd.com, and npdgroupblog.com. Follow us on Twitter: @npdtech and @npdgroup.

Featured Product

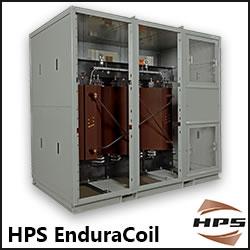

HPS EnduraCoilTM Cast Resin Medium Voltage Transformer

HPS EnduraCoil is a high-performance cast resin transformer designed for many demanding and diverse applications while minimizing both installation and maintenance costs. Coils are formed with mineral-filled epoxy, reinforced with fiberglass and cast to provide complete void-free resin impregnation throughout the entire insulation system. HPS EnduraCoil complies with the new NRCan 2019 and DOE 2016 efficiency regulations and is approved by both UL and CSA standards. It is also seismic qualified per IBC 2012/ASCE 7-10/CBC 2013. Cast resin transformers are self-extinguishing in the unlikely event of fire, environmentally friendly and offer greater resistance to short circuits. HPS also offers wide range of accessories for transformer protection and monitoring requirements.