This paper analyzes this slowdown through a dual lens: first, the well-researched systemic barriers of market design, grid limitations, and policy friction & the critically under-examined operational and delivery bottlenecks within the industry's project execution model.

What’s Slowing Down Solar Deployment in Europe and How to Fix It

Lisandra Perez | Hive Module

Abstract

Europe’s solar sector is facing an unexpected slowdown. Despite record installations and low-cost technology, annual solar growth in Europe plunged from 53% in 2023 to just 4% in 2024. The issue is not technology, it is the system around it.

This paper analyzes this slowdown through a dual lens: first, the well-researched systemic barriers of market design, grid limitations, and policy friction; second, the critically under-examined operational and delivery bottlenecks within the industry's project execution model.

Drawing on academic research, industry reports, and real-world field experience, this article argues that Europe’s solar progress is stalled because policy reforms and project execution practices are evolving out of sync. The solution requires addressing both.

This analysis incorporates insights derived from professional experience in European solar project delivery. These operational perspectives are presented as informed industry analysis to contextualize the systemic challenges identified in the published literature.

1.Introduction: Europe’s Solar Slowdown: A Paradox in the Middle of a Boom

Europe finds itself in a solar energy paradox. On one hand, solar photovoltaic (PV) technology has achieved unprecedented competitiveness, becoming "among the cheapest options for new electricity generation" [2], and is central to the EU’s REPowerEU strategy, which targets 700 GW by 2030. However, deployment has slowed significantly. Recent market data shows a 92% decrease in year-on-year growth, and solar’s contribution to electricity demand growth has dropped sharply [1]. This slowdown indicates that challenges have shifted from cost and technology to systemic, institutional, and operational barriers.

2.Layer One: The Documented Systemic Headwinds

Academic and institutional research consistently identifies three primary macro-level barriers stifling solar momentum in Europe.

2.1 Market Design & the Price Cannibalization Trap

Europe’s energy markets were not built for high-renewable penetration. Solar energy floods the grid when the sun shines, causing predictable price drops, and therefore lower revenues for solar itself.

Analysis confirms this creates "serious financial problems, especially for solar power plants" [4]. The International Energy Agency (IEA) notes that while market designs are evolving, the revenue stability for new utility-scale solar projects in Europe remains a concern without adequate policy support [5]. This market failure disincentivizes new investment just when it is most needed.

2.2 Grid Congestion and Ageing Infrastructure

The physical infrastructure for transmission is a major bottleneck. Europe’s grid is often ageing and was designed for a centralized, predictable flow of power, not for a decentralized, variable-input system like solar.

The result: long connection queues, curtailment in solar-rich regions, mismatch between where electricity is produced vs. consumed

The European Network of Transmission System Operators (ENTSO-E) highlights that significant grid reinforcement and expansion are prerequisites for achieving national climate goals, with thousands of kilometers of new lines needed to integrate planned renewable capacity [6].

2.3 Administrative & Permitting Delays

Permitting remains one of the slowest, least predictable parts of the entire project lifecycle. Even where EU-wide guidance exists, national processes remain uneven.

A Renewables Grid Initiative study identifies permitting delays as one of the top structural blockers for renewable expansion [8].

3. Layer Two: The Overlooked Problem, How Projects Are Built

Even when market and policy conditions are supportive, many projects still get stuck because the project delivery model is broken. Industry experience reveals a delivery model in crisis.

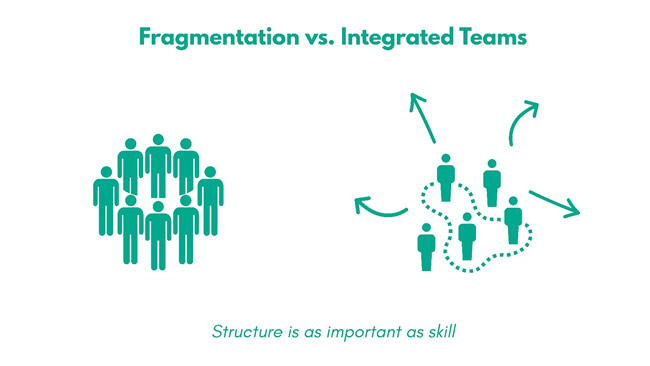

3.1 The Fragmentation Trap and Decision Paralysis

The prevailing industry model relies on long chains of specialized subcontractors. This fragmentation leads to misaligned incentives, communication breakdowns, and a critical absence of unified accountability. When challenges arise, be they technical, logistical, or regulatory, the lack of embedded, on-site decision-making authority causes paralysis. Each layer of subcontracting adds a point of potential failure, slowing progress and inflating costs.

3.2 The Skilled Labor Deficit and the BESS Bottleneck

The solar sector suffers from a chronic shortage of a trained, cohesive workforce. The International Renewable Energy Agency (IRENA) reports that while global renewable energy jobs are growing, skill gaps and inadequate training programs persist, potentially constraining growth [9].

The BESS bottleneck is a prime example. It is not solely a supply chain issue but an integration competency gap. Deploying a functional solar-plus-storage system requires seamless synergy between civil, electrical, and software engineering, a synergy nearly impossible to achieve with disparate subcontractors and a workforce lacking specific cross-disciplinary training [3, 9].

3.3 The Vertical Integration Antidote: A Case in Point

In response to this, a contrasting model has emerged from industry practice: the vertically integrated, compact team. This approach internalizes the end-to-end workflow, from planning and procurement to construction and commissioning, within a single accountable entity.

From direct site experience, even high-performing EPCs struggle when project delivery depends on disconnected subcontractors. A unified, cross-trained team can reduce delays dramatically

4. Fixing the Slowdown Requires a Two-Front Strategy

Europe must address policy barriers and execution barriers at the same time.

4.1 Macro-Level: Policy and Market Reformation

- Market Reform: Transition from energy-only to capacity and flexibility markets. This would provide revenue streams for solar paired with storage, valuing its ability to deliver power on demand and support grid stability [5].

- Grid Acceleration: Coordinated investment in grid digitalization, reinforcement, and smart grid technologies, as outlined in network development plans [6].

- Permitting Standardization: Enforce and digitize permitting across the EU, implementing "positive silence" and designating pre-approved "Renewables Acceleration Areas" to slash development timelines, applying best-practice guidance available [8].

4.2 Micro-Level Fixes (Delivery & Workforce)

The industry needs a shift toward:

- Vertically integrated delivery teams: Most European solar projects still rely on long subcontracting chains: one company for piling, another for mechanical work, another for electrical installation, and another for commissioning.

Every layer adds delays, miscommunication, and diluted accountability. A vertically integrated team replaces this fragmentation with a single unified structure that handles the full A-Z workflow. - Cross-trained workforces: Europe doesn’t just face a worker shortage; it faces a shortage of workers with the right blend of skills. Modern projects demand teams who understand electrical installation, mechanical structures, BESS integration, and grid requirements, not just one part of the process.

- Strong on-site decision-making: Workers wait for subcontractor approvals, subcontractors wait for managers, managers wait for clients, and the project stalls.

- Empowered, competent on-site leadership solves this.

When site managers and team leads are trained and authorized to make real-time decisions, projects move faster, adapt better, and avoid unnecessary standstills. - Direct accountability for project outcomes:With fragmented delivery, responsibility gets blurred. When something goes wrong, everyone points elsewhere, delaying fixes and eroding trust with investors and developers. Direct accountability means one team owning the full project outcome, one internal standard for quality and safety, one decision chain, one responsible entity clients can rely on. This eliminates the “not my task” culture and creates projects that are more predictable, safer, and ultimately more profitable.

This model directly targets the operational failures slowing projects today. Hive Module’s operational approach (compact, integrated electrical and construction teams) is increasingly aligned with what the industry now requires for consistent on-time deployment.

5. Conclusion: Building the Bridge with New Tools and New Teams

The next phase of the transition is more complex, requiring the integration of solar into a resilient, flexible, and intelligent energy system. The analysis reveals that this cannot be achieved by merely tweaking the same old approaches.

The systemic barriers of market design, grid limits, and permitting are very real. However, their negative impact is powerfully amplified by an industry plagued by operational fragmentation and skill shortages. Therefore, the pathway to fixing Europe's solar deployment is necessarily dual. It requires bold policy reforms to correct market signals and modernize infrastructure, coupled with a ground-level revolution in how projects are delivered.

The move toward vertically integrated, expert-led project teams is not a mere niche trend but a necessary evolution. It represents the operational counterpart to the macro-level policy shift, providing the capable, agile, and accountable execution engine required to build the system Europe needs. By simultaneously reforming the rules of the game and elevating the quality of the players, Europe can transform its solar paradox into a story of renewed momentum and secure, clean energy leadership.

Hive Module is a Romania-based energy solutions company specializing in electrical installation services for solar parks, modular infrastructure, and turnkey renewable projects across Europe. With vertically integrated teams, rapid-response execution, and experience on some of the region’s most challenging terrains, Hive Module focuses on building high-performance systems where precision, speed, and adaptability are critical.

The company brings together expertise in construction, logistics, energy systems, and project management to deliver durable, efficient, and future-ready renewable energy installations.

References

[1] SolarPower Europe. (2024). *European Solar Market Report 2024-2028*.

[2] European Commission, Directorate-General for Energy. (2025). 5 things you should know about solar energy.

[3] Industry operational analysis derived from professional solar project delivery experience.

[4] P. P. et al. (2025). EU Energy Markets and Renewable Energy Sources—Are We Waiting for a Crisis? Energies, 18(15), 4201.

[5] International Energy Agency (IEA). (2025). Energy Efficiency Policy Toolkit 2025

[6] European Network of Transmission System Operators for Electricity (ENTSO-E). (2024). TYNDP 2024 Scenario Report.

[7] G. G. et al. (2025). Strategic deployment of solar photovoltaics for achieving self-sufficiency in Europe throughout the energy transition. Nature Communications, 16(6259).

[9] International Renewable Energy Agency (IRENA). (2024). Renewable Energy and Jobs: Annual Review 2024.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product