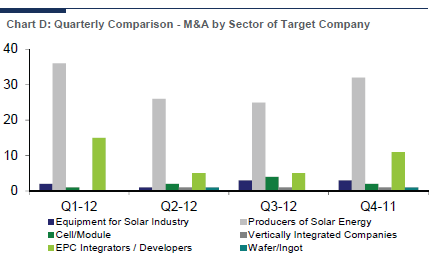

The continued accumulation of solar project portfolios drove much of the M&A activity in 2012, as transaction activity was strongest among targets categorized as producers of solar energy and EPC integrators/developers.

Chaim Lubin | Lincoln International

2012 Deal Volume Comparison

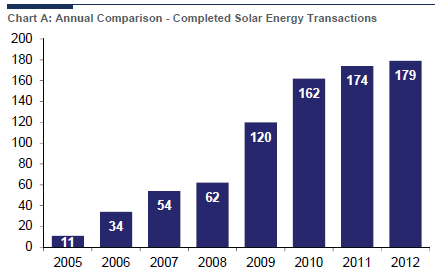

There were 179 completed solar energy M&A transactions in 2012, approximately 3% more than the 174 recorded in 2011 and 10% more than the 162 recorded in 2010. 2012 represents the seventh year in a row that exhibited an increase in transaction volume and is the highest level of transactions recorded in the solar industry.

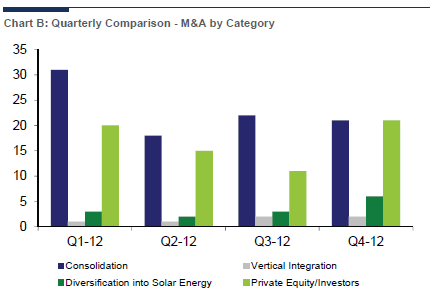

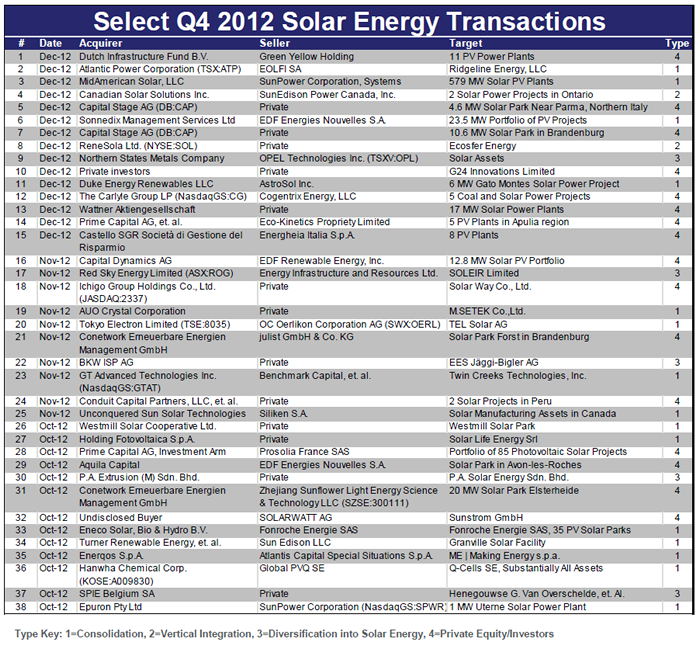

Within the solar M&A transactions, consolidation represented 51% of the volume, or 92 deals in 2012. The next largest category was investment in the solar energy industry by private equity or private investors with 37% of transactions, or 67 deals this year. Diversification into the solar energy industry accounted for 8% of the total, or 14 transactions, and vertical integration accounted for 3% of the total, or six transactions.

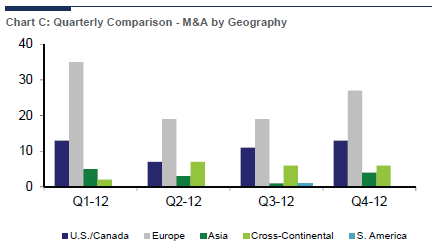

This year, 56% of M&A transactions occurred in Europe, which continues to be the most prevalent geography for M&A. The number of transactions within the U.S./Canada in 2012 was 44, or 25% of the total. This is the same amount of transactions the U.S./Canada recorded in 2011 as well. Cross- Continental transactions accounted for 21 transactions, or 12% of the total for 2012, while deals within Asia represented 13 transactions, or approximately 7%.

In 2012, there were 119 acquisitions of companies categorized as producers of solar energy, representing the most common category of targets at 66% of the total. Often times this represented the acquisition of solar projects. EPC integrators/ developers were the next most frequent acquisition targets, accounting for 36 transactions, or 20% of the total. Companies categorized as cell/module producers accounted for 9 transactions, or 5% of total deals in 2012. Similarly, companies categorized as providers of equipment for the solar industry recorded 9 transactions as well. Companies categorized as vertically integrated companies and wafer/ingot manufacturers represented three and two transactions, respectively. There was also a single transaction that did not fit into a specific category and was labeled as “other” in the first quarter of 2012.

The continued accumulation of solar project portfolios drove much of the M&A activity in 2012, as transaction activity was strongest among targets categorized as producers of solar energy and EPC integrators/developers. Additionally, private equity and private investment in solar has strengthened with improved credit availability and further interest in the solar industry. While transaction activity growth has slowed the M&A market dynamics in solar remain robust with continued interest in M&A.

Further discussion with Chaim Lubin of Lincoln International

How would you summarize the 2012 solar company transaction record as reported in Lincoln’s Q4 Deal Reader?

While the overall growth in transaction volume slowed, at 179 transactions it was a very active year. The large majority of the transactions completed during the year were sales of solar projects, reaching almost 70% of all transaction activity. The sales of solar projects also increased over 50% from 2011 signifying the fastest growth of transaction activity within any sector of the solar energy industry. The market was more focused on acquiring and consolidating project portfolios potentially because this point in the value chain was viewed as less volatile relative to the rest of the industry.

What are the current drivers of transaction activity in the solar energy industry?

The acquisition of solar projects also drove high levels of consolidation during 2012 as the accumulation of solar projects in existing portfolios was classified as consolidation. In addition there was continued growth of private investment in the solar space as that particular category of transaction rationale grew 20% from the level of activity seen from private investment during 2011.

How have the dynamics in the solar energy industry affected valuations?

Overall valuations have come down in the solar industry due to the difficulties being experienced throughout the value chain. There have been a few transactions, in particular within the cells/module sector, that were completed at low valuations mainly due to the distressed nature of the associated operations. However, companies that have and continue to perform are receiving interest in the market resulting in good valuations.

Which solar energy sectors are leading the M&A activity?

By far the most active sector is what Lincoln classifies as “Producers of Solar Energy” as this category includes the sale of solar projects. As mentioned the acquisition of solar projects made up the good majority of all 2012 transaction activity. Beyond the sale of projects another active area for M&A has been within the EPC Integrators/Developers sector. The EPC Integrators/Developers sector is still highly fragmented and could be consolidated. In addition, most industry participants view the EPC Integrators/Developers sector as attractive given that successful integrators and developers of solar projects are still able to capture attractive returns in the industry.

Where do you see transaction activity trending in 2013?

It will be difficult for the market to keep pace with the heights of transaction activity seen in 2011 and 2012. The acquisition and consolidation of solar projects and project portfolios should continue and will most likely remain the most active sector for activity during 2013. It is too be seen whether overall activity will keep pace with 2012, however we are seeing an increase of interest in the solar energy industry as an attractive M&A opportunity, which could lead to transaction activity growth in other sectors of the value chain.

Chaim Lubin

Role at Lincoln International

Advisory Expertise

Chaim has experience in advising companies on mergers and acquisitions, restructuring, fairness opinions, and other strategic matters. His experience includes transactions and advisory services for private equity, Fortune 500, and private company clients. Chaim also has cross-border transaction experience, providing advisory services for transactions involving companies in geographies across Asia and Europe.

Industry Expertise

Chaim specializes in the electronics and renewable energy industries, though he has also been actively involved with companies in the industrial technology, building products, chemicals, office products, and manufacturing & distribution industries. He has relationships with leaders in the renewable energy industry and active acquirers in the electronics industry as well as with contacts throughout the private equity community. Chaim has a strong understanding of the dynamics in the rapidly growing solar industry, and a keen sense of what makes companies and projects attractive and how best to position these to potential partners.

Past Affiliations

Prior to joining Lincoln International, Chaim worked in public accounting for Feeley and Driscoll, P.C. in Boston. Chaim advised and worked with companies in the technology, construction, healthcare, legal, and manufacturing & distribution industries. Chaim is a licensed CPA.

Academic Credentials

Chaim earned a Master of Business Administration degree from the Kellogg School of Management at Northwestern University, a Master of Engineering Management from the McCormick School of Engineering and Applied Science at Northwestern University, and a Bachelor of Science degree from Boston University with Honors.

About Lincoln International

Lincoln International specializes in merger and acquisition advisory services, debt advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and pension advisory services on a wide range of transaction sizes. With fourteen offices in the Americas, Asia and Europe, Lincoln International has strong local knowledge and contacts in key global economies. The firm provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product