The good news is that the clean energy genie is out of the bottle for good. Markets must reflect the new reality of low-cost clean energy and clean energy policy preferences.

As Clean Energy Grows, Electricity Markets Must Evolve

John Moore | NRDC

Reprinted with permission from the NRDC blog:

As 2016 fades away in the rear-view mirror, we reflect on a year of increasing tensions between the wholesale electricity markets—where utilities and other power suppliers purchase, sell, and trade energy to meet our energy needs—and our ever-growing appetite for cleaner, carbon-free power. The need to optimize these markets to support a transforming electric grid is likely to come into sharper focus in 2017.

So, what is the source of these tensions? They arise when power markets devalue the energy from the growing levels of wind, solar, and other clean energy resources. Doing so can increase the price of electricity because the markets are procuring more electricity than necessary to meet our power needs. Problems also occur because power markets focus solely on price, and don’t value other benefits like less pollution.

In short, clean energy resources are quickly becoming the most affordable and dominant resources on the system, so markets need to adapt to reflect their value rather than discriminate against them.

Power markets focus on price

Wholesale electricity markets are auction-based systems for buying and selling electricity. They use electricity supply and consumer demand to set the “clearing price” for electricity within the defined time period. Markets are creatures of economic regulation, as established under the Federal Power Act and overseen by the Federal Energy Regulatory Commission, or FERC. (FERC is an independent government agency in charge of regulating the power grid and the wholesale market rates utilities and others pay for electricity).

Although markets focus nearly entirely on price, economics and the environment do intertwine in the power sector writ large. Electricity production from burning fossil fuels in power plants remains the largest source of greenhouse gas pollution in the United States. For that reason, hundreds of federal and state energy policies exist to clean up pollution from power plants. These policies are having their intended effects, as wind and solar power are now the least-cost option among all technologies in some regions of the country. That’s the good news; the question is whether wholesale electricity markets are up to the task of efficiently and reliably integrating high levels of clean energy resources into the grid.

Markets risk falling behind the times

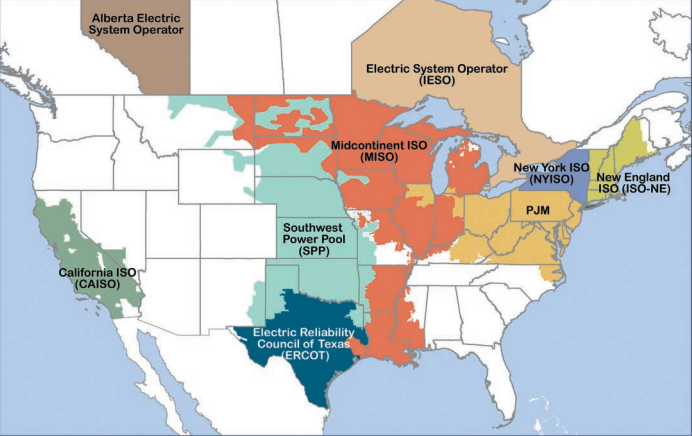

Like deteriorating concrete, cracks are starting to appear in power market design. For example, one type of FERC-regulated market, known as the “capacity market,” is found in the Northeast and Mid-Atlantic regions of the United States where states largely have stepped back from regulating long-term planning for electricity needs. A capacity market is like an insurance pool for power, in which power plants are paid to be available to meet predicted energy demand one to three years in the future, even if the electricity from the plants isn’t ultimately used. Capacity markets aren’t necessary in regions where states still maintain strong regulatory authority over electricity resource planning (for example, in most of the Midwest and Great Plains, and in California and the rest of the West).

Map of organized wholesale market regions

(FERC does not regulate ERCOT because it is not electrically connected to the rest of the US)

Image: Federal Energy Regulatory Commission

One of the problems with current capacity market designs is that they generally only compensate resources if they can promise to be available 24 hours a day, 365 days a year. Coal and other “baseload” resources receive disproportionate benefits in comparison to renewable and other reliable resources because they can run near-full time. This approach, however, is becoming increasingly ill-suited to the evolving, more dynamic grid as we add more wind, solar (including rooftop solar), energy storage, and other resources to the system. Those resources, which eventually will dominate our power mix, can provide significant value to grid reliability even if they don’t run at a sustained output 24/7/365.

The concern with discriminatory treatment isn’t just theoretical; due to design flaws, some current capacity markets discriminate against wind and solar because they can’t guarantee their power output a year in advance—even if they actually are providing power year-round.

Favoring baseload resources also creates reliability risks. Many coal, nuclear, and older gas plants are not as helpful to the grid as newer, faster, and more flexible plants because they cannot be turned on and off easily (and thus can’t help integrate renewables by generating power only when electricity is scarce).

It is an indisputable fact of electricity that “the addition of renewable energy never increases and actually always decreases the need for other power plants.” For that reason, capacity markets will become increasingly ill-equipped to meet grid needs in the years ahead. The focus instead should be on markets to reward “flexible” resources like energy storage, demand response, and fast-ramping natural gas power plants more capable of operating in a dynamic energy system. Markets also need to recognize the reliability values of renewable energy and energy efficiency. Collectively, these resources will power our nation and much of the world through the 21st century.

2016: focusing on market design

This year, the wholesale market operators in New England, PJM, and New York have started to grapple with the tensions between the economic goals of competitive wholesale markets and the environmental goals of state and federal clean energy policies. On the energy market side, one set of proposals involves incorporating a carbon price into the price of electricity sold in the market. (A wholesale energy market is where electricity is bought and sold throughout the day at varying prices and levels in response). On the capacity market side, there are a variety of efforts—some of which are headed in the wrong direction—that could impede the continuing growth of clean energy resources and encourage overbuilding of dirtier energy.

2016 also was a busy year for wholesale electricity markets in the courts. Early this year, the U.S. Supreme Court decided the outcomes of two major cases involving FERC-regulated markets. In the first, Federal Energy Regulatory Commission v. Electric Power Supply Association (EPSA), the high court found that FERC has both the authority and a duty, alongside the states, to regulate demand response in wholesale markets. (Demand response is consumer-driven reductions in electricity consumption in response to price changes or grid operator signals). Demand response can avoid the need to ramp-up more polluting coal and natural gas power plants to meet energy demand, especially during peak times of usage. EPSA also confirms that states have much flexibility to integrate retail demand response programs into wholesale markets.

Then, in April, in Hughes v. Talen Energy Marketing, LLC (Hughes), the U.S. Supreme Court struck down a Maryland plan to incentivize a new natural gas plant, holding that Maryland’s plan interfered with FERC’s regulation of wholesale rates. While the court explained that states may not literally adjust the prices for wholesale electric power sales after FERC sets them, the holding in Hughes is limited, and it preserves states’ abilities to adopt a wide range of clean energy development policies that may incidentally affect wholesale power prices.

Later in 2016, new complaints were filed in federal courts, challenging state energy policies partly on the basis of the Hughes decision. Courts currently are reviewing whether Connecticut and New York policies interfere with FERC-regulated wholesale electricity markets.

Principles for 2017 market reforms

As FERC and wholesale electricity markets prepare for 2017, we offer the following principles to FERC, state regulators, utilities, grid operators, consumers, and other stakeholders to relieve the tensions of the last few years and serve as guideposts for ensuring that the markets support—rather than inhibit—clean energy policies.

Markets should:

- Facilitate rather than frustrate the integration of renewable energy and demand side resources into the grid—ensuring fair access and avoiding discrimination against them.

- Respect legislatures’ and regulators’ authority to set, strengthen, and achieve environmental policies and goals.

- Fully value the contributions of all resources on the system, including those under state regulation and others that may not participate directly in markets.

- Price and compensate products that provide grid flexibility and other reliability services necessary for a dynamic grid that includes high levels of clean energy and emerging technologies.

- Avoid giving unfair preference to higher-polluting or more costly and unneeded “inflexible” baseload resources.

- Support the expansion of regional and interregional system planning because larger, well-interconnected regions improve access to renewable energy resources.

The good news is that the clean energy genie is out of the bottle for good. Markets must reflect the new reality of low-cost clean energy and clean energy policy preferences. For the dynamic grid of the future, “flexibility” is the yardstick by which to measure the resource mix. Fast-responding conventional generation such as natural gas combined-cycle plants, coupled with energy storage and automated demand response, will be among the likely complements to a grid mix dominated by wind and solar energy. Electricity markets will increasingly need to be designed around this resource mix to encourage continued investment in them and to ensure reliability.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.