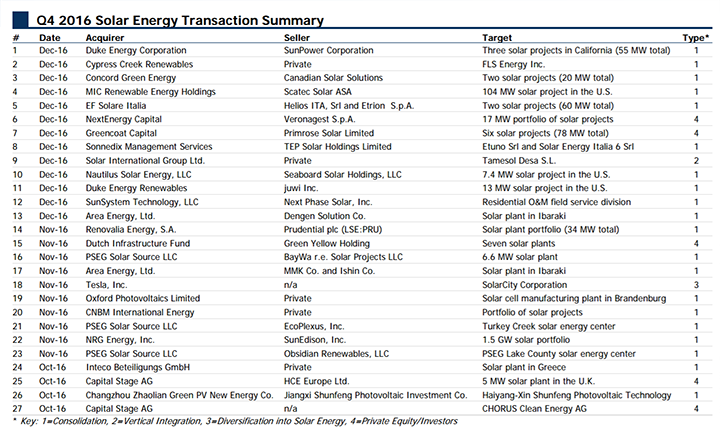

Consolidation amongst producers as well as private equity and private investment in solar largely drove demand for solar deals.

Solar Energy DealReader: Q4 2016

Contributed by | Lincoln International

2016 Deal Volume Comparison

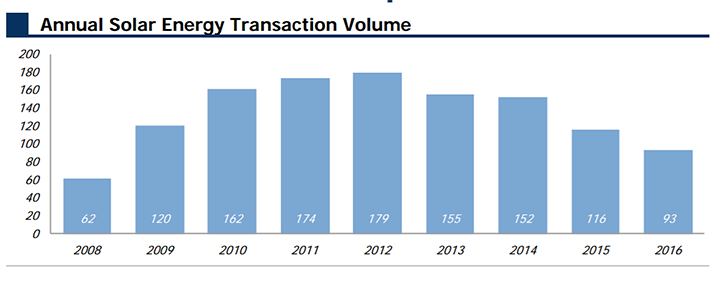

There were 93 completed solar energy M&A transactions in 2016, approximately 20% less than the 116 recorded in 2015. 2016 is the fourth year in a row exhibiting a decline in transaction volume. However, the overall level of transactions in the solar industry is still quite robust given the continued consolidation in the industry.

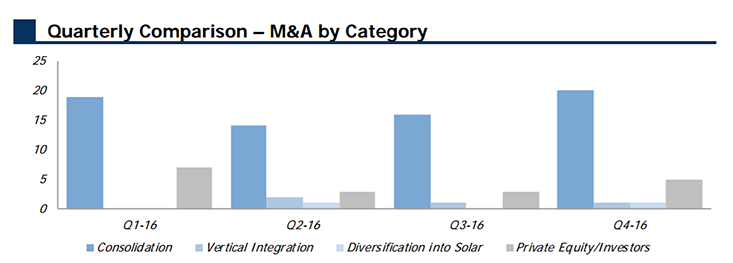

Within the solar M&A transactions, consolidation represented 74% of the volume, or 69 deals in 2016. The next largest category was investment in the solar energy industry by private equity or private investors with 19% of transactions, or 18 deals this year. Vertical integration accounted for 4% of the total, or 4 transactions, and diversification into the solar energy industry accounted for two transactions.

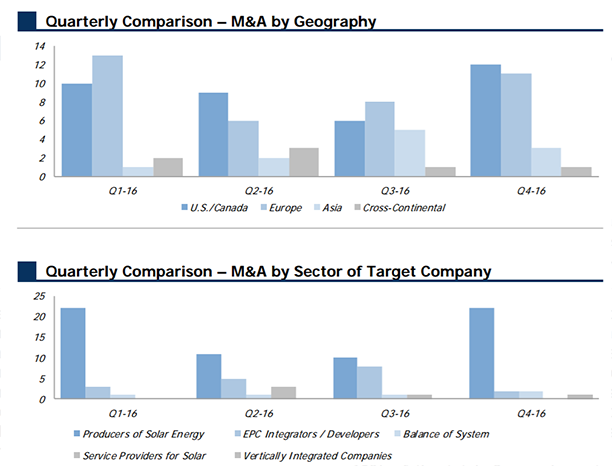

This year, 41% of the solar energy M&A transactions occurred within Europe, surpassing the U.S./Canada as the most active geography for M&A transactions in the sector. This represents a 9% share increase for Europe as compared to the prior year. The number of transactions in the U.S./Canada in 2016 was 37, or 40% of the total. Deals within Asia accounted for 11 transactions, or approximately 12% of the total for 2016, while cross-continental deals accounted for 7 transactions.

There were 65 acquisitions of companies categorized as producers of solar energy, representing the most common category of targets at 70% of the 2016 total. This category primarily represents the acquisition of solar projects. EPC integrators/developers were the next most frequent acquisition targets, accounting for 18 transactions, or 19% of the total. Companies categorized as balance of system providers recorded 5 transactions while companies categorized as service providers for the solar industry recorded 4 transactions in 2016. Vertically integrated companies accounted for one transaction in 2016.

Echoing the trend in 2015, transaction activity was strongest among targets categorized as producers of solar energy. Consolidation amongst producers as well as private equity and private investment in solar largely drove demand for solar deals. Geographically, the European market showed an increase in transaction activity, while the U.S./Canada showed a steady level of activity in terms of its share of the total global transaction volume. While the total number of transactions decreased in 2016, the market dynamics in solar remain supportive for continued interest in M&A.

About Lincoln International

Lincoln International specializes in merger and acquisition advisory services, debt advisory services, private capital raising and restructuring advice on mid-market transactions. Lincoln International also provides fairness opinions, valuations and joint venture & partnering advisory services on a wide range of transaction sizes. With sixteen offices in the Americas, Asia and Europe, Lincoln International has strong local knowledge and contacts in key global economies. The firm provides clients with senior-level attention, in-depth industry expertise and integrated resources. By being focused and independent, Lincoln International serves its clients without conflicts of interest. More information about Lincoln International can be obtained at www.lincolninternational.com.

The content & opinions in this article are the author’s and do not necessarily represent the views of AltEnergyMag

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product