GameChange Unveils $2 Billion Capital Intro™ Program to Fund Solar Projects

SolarWorld collapses as Europe's solar industry eclipsed by China

Sunlight Financial Announces $500 Million Commitment from Tech CU for Residential Solar Loans

SolarCity's solar installations crash nearly 40%

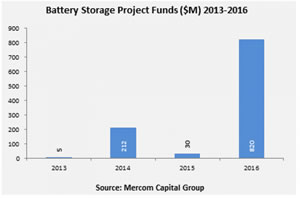

Mercom: Project funding for energy storage totalled US$820 million in 2016

Arcadia's Community Solar Program

Green Tech Investing on the Rise: $17 Million and Another $1 Million on the Way

Alternative Energy Project Financing

Floating solar power sector has "considerable" bank support

How To Access Financing For Your Next Commercial Solar Project

SEALED LAUNCHES $7.5 MILLION ENERGY SAVINGS FUND WITH NY GREEN BANK, TURNS RESIDENTIAL ENERGY SAVINGS INTO A FINANCIAL COMMODITY

Viridity Energy Raises $8.5 Million in Growth Round

SunEdison Files for Chapter 11 Bankruptcy Protection

BayWa r.e. partners with Spruce Finance to offer a new financing product

The World's Largest Renewable Energy Developer Could Go Broke

Records 16 to 30 of 70

First | Previous | Next | Last

Featured Product

.jpg)